Days payable outstanding is one of several key accounts payable KPIs to track and acts as a stand-in for overall operational efficiency. At its core, the DPO helps business owners and analysts determine how effectively and efficiently a company balances cash flow and vendor relations while also acting as a proxy to determine how creditworthy outsiders judge you. Understanding how the days payable outstanding ratio is an important step in getting a strategic, birds-eye view of your business while opening opportunities for improvement.

What is the Days Payable Outstanding Ratio?

Days payable outstanding, usually shortened to DPO, measures how quickly (or slowly) your company pays vendors and suppliers on average. Though accounts payable automation tools do let you calculate how long each AP entry takes to close, finding the days payable outstanding ratio using an overall average is a more useful tool for strategic decision-making without getting lost in the weeds.

The DPO Formula

Your AP or accounting platform likely automates the days payable calculation, but understanding the mechanics of the ratio is useful for generating insight – by knowing what feeds the DPO calculation, you can understand what operational tweaks or modifications you can make to improve the DPO calculation.

But first, we need to see the DPO formula:

DPO = (Average Accounts Payable ÷ Cost of Goods Sold) × number of day

Where:

Average Accounts Payable: Your average accounts payable balance is found by adding your beginning AP balance to the end and dividing by two. For example, if you’re finding your annual DPO for fiscal year 2023, you’d add Q4 2022’s AP balance (since that’s how you started 2023) to Q4 2023’s balance, then divide by two.

CoGS: Cost of goods sold, a direct figure reflecting manufacturing, distribution, delivery, and similar costs associated with your product. CoGS is found on your income statement but, alternatively, you can use Cost of Sales. If you go this route, you calculate the cost of sales by adding your beginning inventory balance to purchases over the period, then subtracting the ending inventory.

Days in Period: This is the total number of days elapsed throughout the measured period, i.e., 90 days for a quarterly DPO calculation or 365 for an annual assessment.

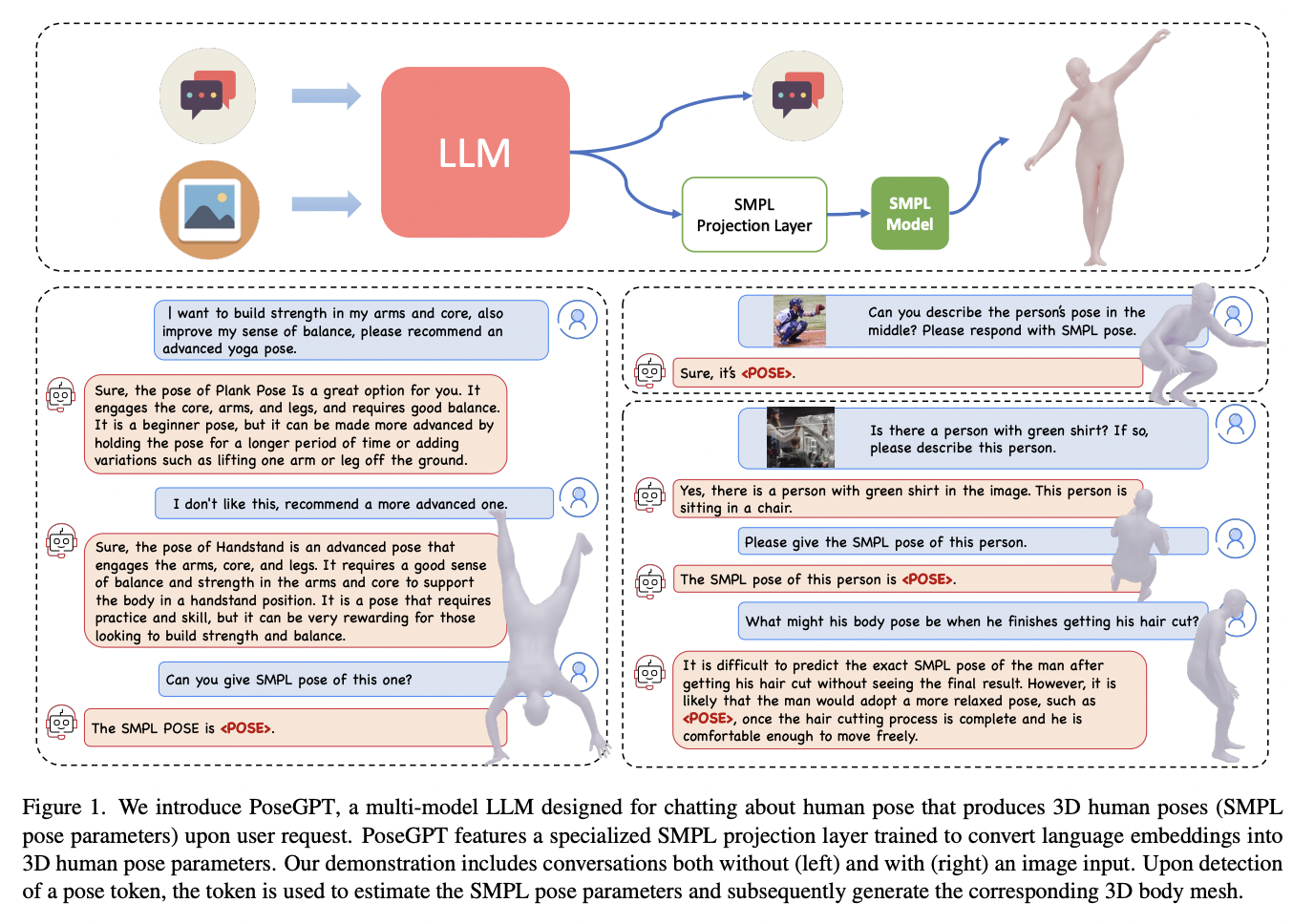

A DPO Calculation

Let’s see how this plays out in real life. We’ll use Ford’s end-of-year report for 2022 to find the company’s annual DPO calculation. Remember that we’ll need to find the CoGS on our income statement alongside our beginning and ending AP totals from the balance sheet.

Source: Ford

Ford uses cost of sales as its metric, so, in this case, its annual total is $134.394 billion – a hefty price tag, but remember that automaking is an expensive endeavor.

Source: Ford

Next, we’ll average Ford’s payable balance by adding 2021’s ending balance to 2022’s ending balance and dividing by two – we get $23.977 billion as our average accounts payable balance.

Finally, we’ll pull it all together:

This means that, on average, Ford takes 65 days to pay back its AP balance. But what does the DPO formula tell us from a strategic and operational perspective?

How Do You Interpret Days Payable Outstanding?

Remember that your business’ operations live and die by your overall cash flow, and a major cash vacuum is your accounts payable balance. While vendors and suppliers need to be kept happy, you also want to generally defer sending money out of your business for as long as possible (except for niche circumstances, like early payment discounts). In these cases, a higher DPO indicates you’re keeping cash in your business, for longer. It also may mean:

- You have greater flexibility in finding investment opportunities or business growth, since you have more cash on hand.

- Your vendors rate your creditworthiness and trustworthiness highly and trust you to pay your debt.

A low days payable outstanding isn’t usually preferable, since it can indicate you’re missing out on opportunity to invest or grow by sending out cash sooner than needed. Alternately, a low DPO could indicate poor lending terms from vendors which, in turn, can be an indictment on your overall creditworthiness.

On the other hand, judging a high/low days payable outstanding formula output isn’t a binary assessment; it isn’t just “good” if it’s high and “bad” if low. Instead, it’s contextual. If your business is struggling, a high DPO doesn’t indicate good credit and prudent cash management – it means you might not have the money to pay debts on time. Likewise, a low days payable outstanding isn’t bad. You might operate in a niche industry where rapid repayment is expected, so your DPO should be judged on a relative, rather than absolute, basis. Or your suppliers offer early payment discounts, in which case a low DPO means you’re proactively saving money in the long run.

Conclusion

Cash management is key to business longevity, but keeping suppliers happy is too. In both cases, the days payable outstanding acts as a metric to balance your cash and capital allocations with maintaining positive vendor relations by paying on time. The DPO also acts as a stand-in for your overall operational and accounts payable efficiency too; since the DPO formula tells us how effectively you can plan and manage resources and relationships, it’s usually reliable to draw broader conclusions from that data point.

From a strategic perspective, the DPO also helps project future cash flow when running financial modeling programs. Net working capital (NWC) includes your accounts payable balance, and NWC informs your free cash flow (FCF) projections. FCF is one of the top valuation variables, so balancing your DPO with FCF forecasting in mind is also useful if considering an acquisition, buyout, or otherwise planning for your company’s future and need up-to-date enterprise valuation.