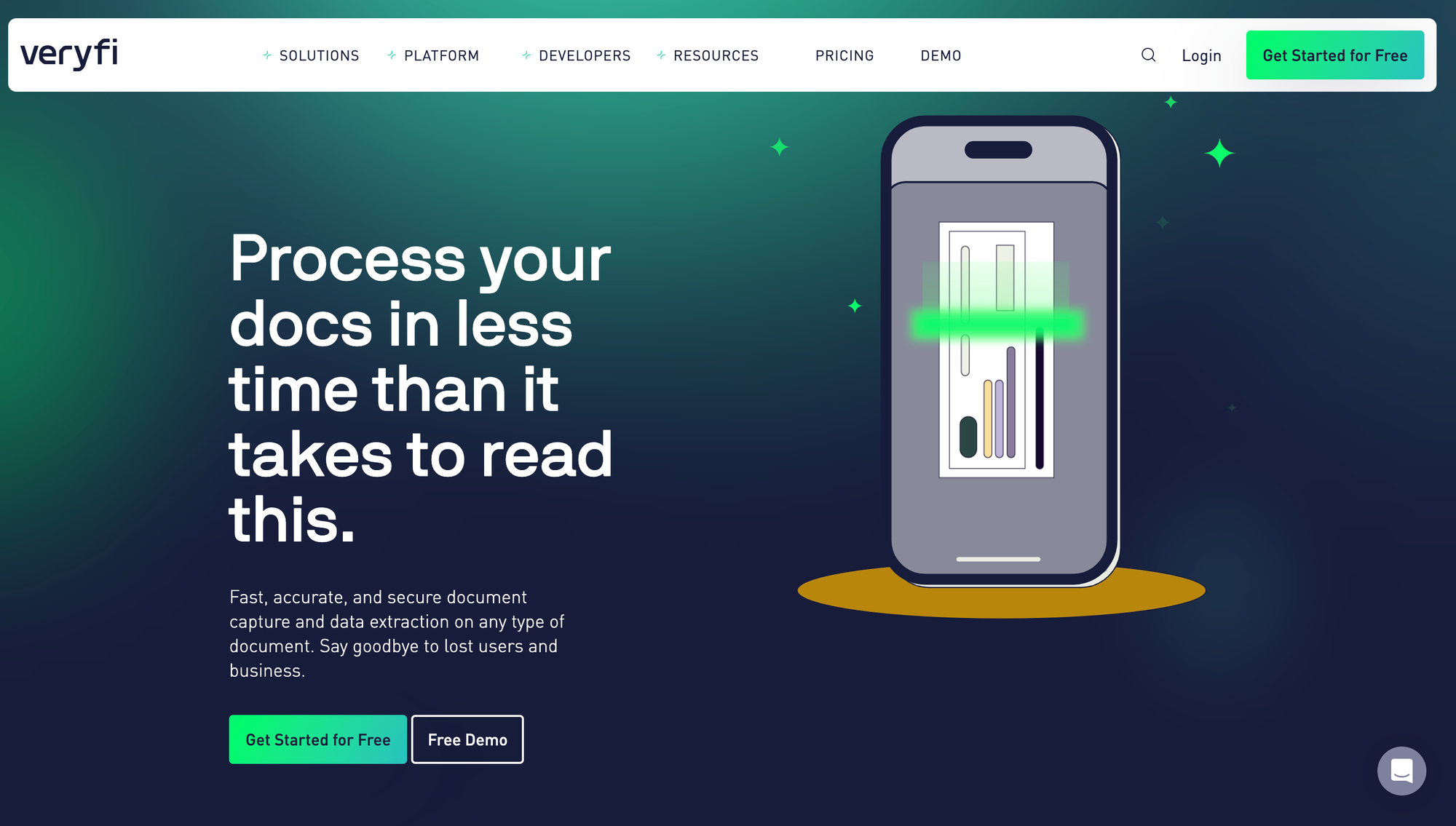

Veryfi is a popular OCR tool known for its speed and accuracy in data extraction.

While its free mobile app and API integration make it flexible for many users, its limitations, such as a 15-page processing cap and strict API rate limits, can hinder large scale document processing.

For businesses needing more flexible, advanced document processing solutions, exploring alternatives to Veryfi is essential.

Stay with us as we explore the best Veryfi alternatives with OCR capabilities that also provide speed, accuracy and more flexibility.

Quick comparative table: Top Veryfi alternatives

Given the many options available, choosing the appropriate OCR or document processing tool can be overwhelming. To help you make an informed decision, we have compiled a comparative table of eight popular alternatives to Veryfi.

| S.No. | Name | Highlight Feature | Free Trial | Pricing | Top User Review |

|---|---|---|---|---|---|

| 1 | Veryfi | Quick OCR with minimal manual intervention for expense and receipt management. | Yes | Starts at $500/month | Fast processing, but customization options are limited. |

| 2 | Xero Hubdoc | Automated data capture from bills and receipts, integrated with Xero. | Yes | Included with Xero Plans | It is convenient for Xero users but has occasional syncing issues. |

| 3 | Zoho Expense | Advanced expense management with auto-scanning and multi-currency support. | Yes | Starts at $4/user/month | Great for managing expenses, but setup can take time. |

| 4 | Nanonets | AI-powered OCR with customizable workflows and in-built integration with ERP tools. | Yes | Starts at $0.3/page | High OCR accuracy, intuitive interface, and quick setup. |

| 5 | Taggun | Real-time receipt OCR API focused on speed and simplicity. | Yes | $0.08/scan for under 5000 scans | Straightforward API and quick response times. |

| 6 | Klippa | Real-time data extraction with a focus on security and GDPR compliance. | Yes | Custom pricing | User-friendly design and efficient processing. |

| 7 | DEXT | Comprehensive expense management with automated data extraction. | Yes | Starts at ~$230/month | Feature-rich but slightly overwhelming interface. |

| 8 | Mindee | AI-driven document parsing with pre-trained models for diverse documents. | Yes | Custom pricing | Easy integration and high accuracy. |

| 9 | Google Cloud Vision API | Robust image analysis, including text detection and classification. | Yes | Feature-based pricing | Powerful features but require a learning curve. |

1. Xero Hubdoc

Xero’s Hubdoc is a data capture tool that streamlines financial document management by automatically extracting critical information from bills and receipts. Users can upload documents via email, mobile app, or desktop, and Hubdoc processes these to create transactions in Xero, complete with attached source documents.

This integration simplifies reconciliation, reduces manual data entry, and ensures financial records are up-to-date and accurate.

Who should use Xero Hubdoc?

💡

Xero Hubdoc is ideal for solo traders, new businesses, and self-employed individuals seeking to automate financial document management and streamline bookkeeping processes.

Features that matter

- Automated data capture: Extracts key details from bills and receipts via mobile, email, or desktop uploads.

- Xero integration: Creates draft transactions in Xero with attached source documents for easy reconciliation.

- Bank statement conversion: Turns PDFs into CSVs for quick import into Xero.

- Secure storage: Organizes documents in folders with unlimited storage for easy access.

- Role management: Assigns user roles to control access and ensure data security.

Pros and cons of Xero Hubdoc

| Pros | Cons |

|---|---|

| Efficient data extraction | Occasional sync issues |

| Integrates well with Xero | Learning curve for new users |

| Saves time by automating tasks | Limited customization options |

| Mobile-friendly for on-the-go use | Pricing may be high for small businesses |

2. Zoho Expense

Zoho Expense is an advanced expense management solution that simplifies and automates financial workflows. Powered by AI, it streamlines the tracking, reporting, and approval of business expenses for teams and individuals.

Zoho Expense’s auto-scan feature accurately extracts key data from receipts, enabling faster processing and reducing manual errors. It supports multi-currency and multi-language capabilities and offers global scalability for businesses of all sizes.

With a user-friendly interface and seamless integration with accounting systems, Zoho Expense empowers finance teams and decision-makers to gain better control over spending while improving operational efficiency and reducing costs.

Who should use Zoho expense?

💡

Zoho Expense is ideal for mid-market and large enterprises seeking to automate and streamline their expense management processes. Its robust features,customisation capabilities and scalability make it ideal for mid-size and large organizations

Features that matter

- Receipt auto-scan: Automatically extracts data from receipts to create expenses.

- Policy compliance: Enforces company expense policies to ensure adherence.

- Multi-level approvals: Configures custom approval workflows for expense reports.

- Real-time analytics: Provides insights into spending patterns and trends.

- Mobile accessibility: Allows expense reporting via mobile devices.

- Credit card integration: Syncs corporate card transactions for easy reconciliation.

- Per diem management: Automates daily allowances for business travel.

- Multi-currency support: Handles expenses in various currencies with automatic conversion.

- Customizable fields: Tailors expense forms to meet specific business needs.

- Seamless integrations: Connects with accounting and ERP systems for streamlined operations.

Pros and cons of Zoho Expense

| Pros | Cons |

|---|---|

| User-friendly interface | Limited integration with some apps |

| Robust mobile app for expense tracking | Delays in customer support |

| Features like auto-scan and approvals | Credit card syncing issues reported |

| Competitive pricing for enterprises | Customization may have a learning curve |

| Regular updates with new features | Setup can be time-consuming initially |

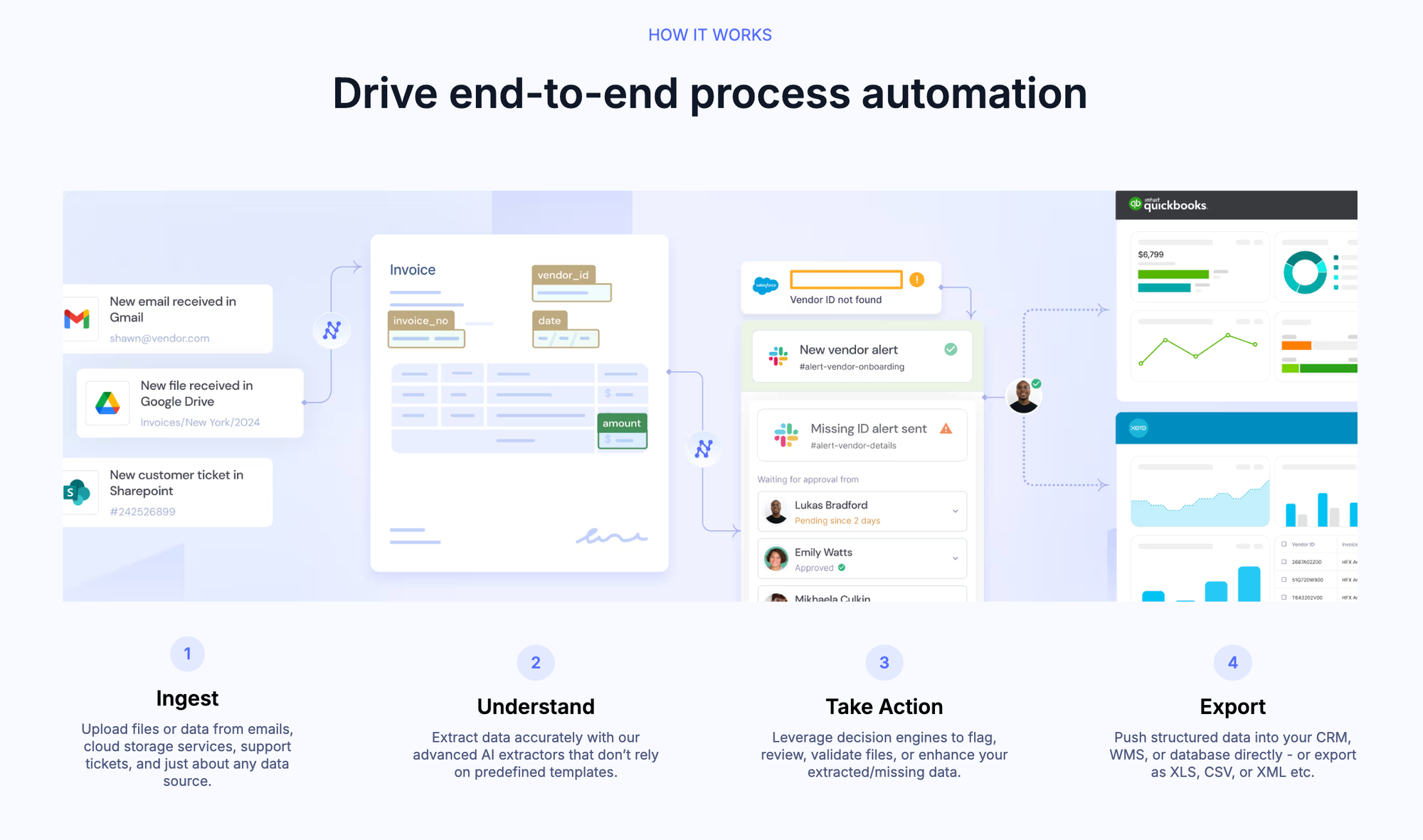

3. Nanonets

Nanonets OCR‘s advanced capabilities in automated document processing allow businesses to ingest data from various document types, including invoices, receipts, contracts, bank statements, IDs, and claim forms. This achieves over 90% accuracy across the 10M+ monthly files processed globally.

Nanonets helps automate tasks like approval workflows, data validation, and matching processes with a user-friendly interface, extensive OCR API integrations, and learnable decision engines.

It reduces human errors, accelerates turnaround times (6x faster), and offers significant cost savings (30%+). Supporting 100+ languages and unmatched semantic understanding, it stands out by enabling zero-training models to process documents instantly.

Who should use Nanonets?

💡

Nanonets is ideal for medium to large businesses seeking to automate complex document workflows with accurate AI models and customizable integrations.

Features that matter

- AI-powered automation: Processes structured and unstructured documents with 90%+ accuracy.

- Document support: Handles invoices, receipts, contracts, IDs, and more.

- Multi-language: Supports 100+ languages, including Polish and Czech.

- Fast processing: Reduces time per page from minutes to seconds.

- Cost savings: Cuts 30%+ on manual processing costs.

- Export options: Integrates with CRMs, WMS, databases, or exports as XLS/CSV/XML.

- Scalable: Processes thousands of documents and automates workflows without increasing team size.

- 24/7 availability: Always-on AI for continuous operations.

- Tailored solutions: Supports claims, onboarding, AP automation, and inventory management.

Pros and cons of Nanonets OCR

| Pros | Cons |

|---|---|

| Highly accurate AI models eliminate template dependency | Premium pricing for low-volume users |

| Processes complex unstructured documents | Model training requires setup time |

| Advanced table and line recognition | The interface needs more streamlining |

| Handles poor-quality scans well | Some features have a learning curve |

| Built-in integration with QBO, Xero, Sage, Netsuite |

4. Taggun

Taggun offers an advanced OCR API designed to convert receipts and invoices into structured data efficiently. With support for over 85 languages, it processes diverse formats, including images and PDFs, ensuring high accuracy in data extraction.

Taggun’s machine learning models handle various regional data points, such as Australian Business Numbers and Brazilian CNPJs, catering to global business needs efficiently.

It facilitates seamless integration into applications, enabling real-time receipt scanning and validation.

Who should use Taggun?

💡

Taggun is ideal for mid-sized to large software companies, fintech firms, and e-commerce platforms that need real-time, automated, and accurate receipt and invoice scanning.

Features that matter

- Real-time processing: Instantly converts receipts and invoices into structured data.

- Multi-language support: Handles over 85 languages for global applicability.

- Versatile file compatibility: Processes various formats, including JPEG, PNG, GIF, and PDF.

- High accuracy: Delivers over 90% accuracy in data extraction.

- Line item extraction: Captures detailed product information from receipts.

- Customizable API: Offers a developer-friendly API for seamless integration.

- Receipt validation: Validates receipts for loyalty programs and fraud detection.

Pros and cons of Taggun

| Pros | Cons |

|---|---|

| Easy API integration with clear docs | Occasional inaccuracies in detection |

| Quick and accurate OCR processing | Limited features in lower-tier plans |

| Supports multiple languages globally | Pricing may be high for small businesses |

| Responsive customer support | Slower API response during peak times |

| Flexible pricing for scaling | Advanced features need additional setup |

5. Klippa

Klippa specializes in AI-driven document automation solutions designed to streamline business processes. Their flagship product, Klippa DocHorizon, offers intelligent document processing capabilities, enabling organizations to scan, read, sort, extract, anonymize, convert, and verify documents at scale.

By integrating advanced OCR technology, Klippa transforms unstructured data into structured formats, facilitating seamless data management and reducing manual workloads. Committed to enhancing operational efficiency, Klippa’s solutions provide tools that empower businesses to achieve more in less time.

Who should use Klippa?

💡

Klippa is most suitable for small businesses, especially those in finance, retail, and logistics. Its cost-effective OCR and document automation solutions add value.

Features that matter

- Document automation: Scans, reads, sorts, extracts, and verifies documents.

- Advanced OCR: Extracts data accurately from various document types.

- Data anonymization: Masks sensitive information for compliance.

- Document verification: Validates authenticity to prevent fraud.

- Identity verification: Analyzes documents and detects liveness for ID checks.

- API and SDK integrations: Seamlessly connects with existing systems.

- Workflow automation: Creates custom processes to streamline tasks.

Pros and cons of Klippa

| Pros | Cons |

|---|---|

| Accurate OCR for data extraction | Limited customization for templates |

| Intuitive and user-friendly interface | API documentation could be improved |

| Responsive and prompt support | Occasional inaccuracies in OCR results |

| Seamless integration with systems | Pricing may be high for some features |

6. DEXT

Dext is a top bookkeeping automation provider. It helps businesses, accountants, and bookkeepers capture, process, and manage financial documents efficiently.

With seamless integration across major accounting software and over 11,500 financial institutions worldwide, Dext streamlines workflows by automating data extraction from receipts, invoices, and bank statements.

Its platform offers real-time expense tracking, customizable approvals, and advanced analytics for informed decisions. By reducing manual entry and errors, Dext boosts productivity and lets professionals focus on growth and client service.

Who should use DEXT?

💡

Dext is ideal for small to medium-sized businesses, accountants, and bookkeepers seeking to automate data entry and streamline financial workflows. Its features are particularly beneficial for professionals aiming to enhance efficiency and accuracy in financial management.

Features that matter

- Automated data capture: Collects receipts and invoices via mobile, email, or integrations, removing manual entry.

- Seamless accounting integration: Syncs with major accounting software and financial institutions.

- Expense management: Simplifies reporting and approvals for better financial control.

- Real-time data processing: Instantly digitizes and categorizes financial documents.

- User-friendly interface: Intuitive design for easy navigation.

- Robust security measures: Ensures data protection and compliance.

- Comprehensive support: Provides extensive resources and assistance for users.

Pros and cons of Dext

| Pros | Cons |

|---|---|

| Accurate data extraction and processing | Advanced features require technical expertise |

| Seamless integration with accounting tools | Pricing may be high for small businesses |

| User-friendly and intuitive interface | Limited mobile app functionality |

| Streamlines financial workflows | Customer support could be improved |

| Robust security and compliance | Lacks flexibility for niche integrations |

| Real-time data processing | Some features have a learning curve |

7. Mindee

Mindee is an AI-powered platform that automates document processing, converting unstructured data into actionable insights with over 90% accuracy. It handles a wide range of documents, including invoices, receipts, contracts, and IDs, processing millions of files monthly.

With a user-friendly interface and advanced decision engines, Mindee accelerates workflows, reduces errors, and cuts costs by 30%+. Supporting many languages and zero-training models, it delivers quick results.

Who should use Mindee?

💡

Mindee is best suited for medium to large enterprises and software vendors where advanced document processing is critical to optimizing operations and reducing manual workflows.

Features that matter

- AI-powered data extraction: Accurately captures data from various documents, including invoices, receipts, and IDs.

- Seamless integration: Easily integrates with existing systems to streamline document workflows.

- Customizable solutions: Offers tailored document processing to meet specific business needs.

- Open-source OCR toolkit: Provides docTR, an open-source OCR toolkit for flexible text recognition.

- Scalable platform: Handles large volumes of documents efficiently, suitable for businesses of all sizes.

- User-friendly interface: Features an intuitive design for easy navigation and operation.

- Robust security measures: Ensures data protection and compliance with industry standards.

- Comprehensive documentation: Offers extensive resources and support for developers and users.

Pros and cons of Mindee

| Pros | Cons |

|---|---|

| Accurate data extraction | Advanced features need expertise |

| Seamless system integration | Limited language support |

| Customizable for business needs | Pricing details unclear |

| Scalable for high volumes | No mobile app for on-the-go use |

| User-friendly interface | Limited customer support details |

| Robust data security | Extra development for niche systems |

8. Google Cloud Vision API

Google Cloud Vision API enables developers to integrate advanced image analysis capabilities into their applications. It uses Google’s machine learning models to offer features such as image labeling, OCR, face and landmark detection, and explicit content tagging.

The API supports a wide range of image formats and can process images stored in various locations, including Google Cloud Storage and the web. Google Cloud Vision API simplifies the development process, allowing businesses to efficiently derive actionable insights from visual data.

Who should use Google Cloud Vision API?

💡

Google Cloud Vision API is ideal for developers seeking to incorporate advanced image analysis into their applications without extensive machine learning expertise.

Features that matter

- Image labeling: Identifies objects and entities in images with descriptive labels.

- OCR: Extracts text from images, including support for handwriting and multiple languages.

- Face detection: Detects human faces, recognizing emotions and facial landmarks.

- Landmark detection: Identifies famous landmarks and provides geographic coordinates.

- Logo detection: Recognizes brand logos within images.

- Explicit content detection: Flags inappropriate or sensitive content for moderation.

- Image properties analysis: Analyzes image attributes, including dominant colors and composition.

- Object localization: Detects multiple objects in images and provides bounding boxes and labels.

Pros and cons of Google Cloud Vision API

| Pros | Cons |

|---|---|

| High accuracy in image recognition | Premium pricing for high-volume usage |

| Easy integration with existing applications | Limited customization for specific use cases |

| Supports multiple languages for text extraction | Occasional inaccuracies with low-quality images |

| Comprehensive documentation and support resources | Requires internet connectivity for API access |

| Robust features include OCR, face detection, and object localization | Learning curve for users without prior experience |

About Veryfi

Veryfi addresses efficiency in data processing by offering advanced OCR technology that transforms unstructured documents into structured, actionable data. The AI-powered solution automates the extraction of information from invoices, receipts, checks, and more, enabling seamless integration into various applications.

💡

Small accounting businesses and bookkeepers prefer Veryfi for its user-friendly mobile app and efficient API setup.

Features that matter

- AI-powered OCR: Automatically extracts data from receipts and invoices with high precision.

- Real-time processing: Provides instant access to structured data.

- Global compatibility: Supports 90+ currencies and 39 languages.

- Secure compliance: Meets SOC 2, GDPR, and HIPAA standards.

- Seamless integrations: Connects with tools like QuickBooks and Xero.

- Mobile capture: Enables high-quality data capture via smartphones.

- Developer APIs: Offers APIs and SDKs for easy system integration.

- Expense management: User-friendly app for tracking expenses on the go

Pros and cons of Veryfi

| Pros | Cons |

|---|---|

| Fast and accurate OCR | Expensive for small businesses |

| Intuitive interface | Occasional OCR errors |

| Works well with accounting tools | Delays in customer support |

| Manage expenses on the go | Advanced features only in higher plans |

Why choose Nanonets AI over Veryfi?

Nanonets stands out with its advanced AI capabilities, superior customizability, and broader support for various document types. While this might seem like a general statement, there are several specific reasons why many users prefer Nanonets’ advanced AI-enabled OCR.

💡

– M. Aflah PT, Solusi Aplikasi (Indonesia)

Some arguments in favor of Nanonets

Named by G2 as a global OCR leader, Nanonets offers exceptional OCR accuracy, customer support, and workflow automation performance. Nanonets also stands out as the trusted choice of Fortune 500 companies worldwide.

- Its robust AI engine stands out, with a 95%+ field and line item extraction accuracy while learning to precisely handle diverse use cases and continuously improving.

- Its enhanced software interoperability reduces setup time, and it comes with built-in 30+ integration options with all major ERP and accounting tools (Xero, Quickbooks Online, Sage, Oracle Netsuite, etc.).

- Nanonets processes files in seconds, presenting data in customizable list views and multiple export options with rule-based alerts for immediate attention and verification.

- With a fast implementation, attention to each customer’s unique needs for customization, and effective customer support, Nanonets stands out as a must-have in your tech stack.

Nanonets vs Veryfi OCR

| Metric | Nanonets | Veryfi |

|---|---|---|

| Integration Support | Extensive | Limited |

| Language Support | 100+ | Limited |

| Customization | High | Moderate |

| AI Model Training | Yes (with AI confidence scores) | No |

| On-Premise Deployment | Available | Not Available |

| Dedicated Account Manager | Yes | No |

| White-Labeled UI | Yes | No |

| Document use cases | 300+ documents | Receipts and expenses majorly |

| OCR data capture | 95%+ accuracy with AI | …. |

Frequently Asked Questions (FAQs) about Veryfi

Veryfi automates financial document processing using advanced OCR. It extracts data from receipts and invoices, integrates with accounting software, and provides real-time expense tracking to eliminate manual data entry.

What are some popular alternatives to Veryfi?

Alternatives to Veryfi include Nanonets, Klippa, Xero Hubdoc, Google Cloud Vision API, ABBYY, and Dext. These tools offer features like advanced OCR, expense tracking, and integration with accounting systems.

Which Veryfi alternative is best for small businesses?

Zoho Expense and Dext are great for small businesses due to their ease of use, affordable pricing, and flexibility in managing expenses and invoices.

How does Nanonets compare to Veryfi?

Nanonets excels with its AI-driven OCR, multi-language support, and the ability to process unstructured data, making it more versatile than Veryfi.

Are Veryfi alternatives easy to integrate with accounting tool?

Yes, most alternatives, such as Klippa, Xero Hubdoc, and Nanonets, provide seamless integration with CRMs, accounting tools, and APIs, ensuring smooth workflows.

Veryfi vs. Hubdoc vs. DEXT: Who is better?

Choose based on your specific business needs:

- Veryfi: Best for quick, automated data extraction.

- Hubdoc: Ideal for Xero and QuickBooks users.

- DEXT: Comprehensive for detailed expense management.