Need to reconcile bank statements but tired of doing it manually? Looking for a bank statement extraction software? Look no further because we have you covered.

We have researched and listed the 10 best bank statement extraction software in the market for 2024. Not just that, you will find the pros, cons and the pricing details for each, detailed in the article below.

Whether you are a tax consultant, a freelancer or a business looking to automate your bank statement reconciliation workflow, our curated list will help you find the right software for yourself. But, before we dive in, let us take a quick look at a comparative overview of the tools summarised below:

| Software | Pros | Cons | Pricing |

|---|---|---|---|

| Nanonets | High accuracy End-to-end automation Secure and scalable |

Costly Potential learning curve AI may overfit |

Pay-as-you-go: $0.3/page Pro: $999/mo Enterprise: Custom |

| FreshBooks | User-friendly Integrates well with accounting features Suitable for small businesses |

Limited OCR Not specialized for bank statement extraction Basic reconciliation |

Lite: $19/mo Plus: $33/mo Premium: $60/mo |

| ProperSoft | Supports various formats Cost-efficient lifetime license Offline capabilities |

Complicated UI Limited accuracy Expensive lifetime license |

Monthly: $19.99 Yearly: $119.99 Lifetime: $199.99 |

| DextPrepare | Handles complex formats Scalable Robust security |

Initial setup required Higher pricing for small businesses |

Essentials: $229.99/mo Advanced: $247.23/mo Custom |

| Infrrd | High accuracy Handles large volumes Customizable Scalable |

Initial setup time Challenges with non-standard documents Ongoing costs |

Basic: Custom Enterprise: Custom Enterprise Plus: Custom |

| Docuclipper | Optimized for bank statement extraction Handles complex documents Integrates with tools |

Specialized for extraction Requires setup for custom formats |

Starter: $39/mo Professional: $74/mo Business: $159/mo |

| Parseur | Easy to use Supports various formats Flexible template creation |

Setup time Template limitations Limited accuracy for complex layouts |

Micro: $39/mo Mini: $69/mo Starter: $99/mo Premium: $199/mo |

| Parsio | Flexible Handles both digital and scanned documents Integrates with systems |

Manual setup needed Accuracy depends on parsing rules Limited financial optimization |

Free: 100 credits/mo Starter: $49/mo Growth: $149/mo Business: $249/mo |

| Super.AI | Customizable High accuracy Scalable Human verification |

Significant setup Learning curve Higher pricing |

Custom pricing based on volumes and customization |

| CaptureFast | Flexible High accuracy Scalable Integrates with financial workflows |

Setup and training needed Not bank-statement focused Learning curve |

Free: 100 pages/mo Basic: $69/mo Professional: $299/mo Business: $799/mo |

1. Nanonets

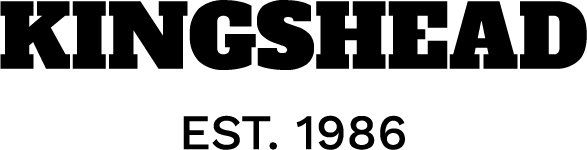

Featuring at the top of the list and the best bank statement reconciliation software in 2024, is Nanonets. Powered by generative-AI, Nanonets offers a pre-trained bank statement extractor as well as a zero-training extractor that can be set up for bank statements in seconds.

It can handle bank statements with complicated layouts (think, multi-line items, nested tables, etc.) all different from one another, as well as support 110+ languages.

It has a built-in “data actions” centre which offers advanced formatting capabilities, like, adding/removing fields, fuzzy-matching fields against external databases, automatic categorisation, etc. It also has approval workflows built-in that can flag bank statements with missing fields or incorrectly extracted data points.

With its one-click integration and mapping capability, you can set up automated export from your bank statements directly into external software, be it accounting software like Quickbooks, Sage, Xero, etc. or ERPs, like Salesforce. Combine that with automated import and you have an entire automated workflow, end-to-end.

Key Features:

- Can reconcile bank statements against other financial documents like, Invoices, Receipts, Purchase Orders, etc.

- Automated import from email, cloud storages, APIs, or databases

- Automated export into external software, be it accounting software like Xero, Sage, Quickbooks, Salesforce, ERPs like Salesforce or databases like MsSQL, Amazon S3, etc.

- “LLM Actions” section to automatically categorise transactions

- Built-in validation workflows

✅

1. Can automate end-to-end bank statement reconciliation processes

2. Easy-to-use, no-code user interface

3. Offers high accuracy for standard documents like bank statements

4. Can handle bank statements from multiple languages, having complicated layouts

5. Can handle large volumes in a secure manner. We are SoC certified, HIPAA and GDPR compliant.

6. Offer easy to understand API endpoints

❗

1. If not properly managed, the AI models might become too specialised to a particular format, affecting performance on slightly different layouts.

2. The cost may be higher compared to simpler solutions, potentially making it less accessible for small businesses or low-volume users.

3. Despite the no-code interface, users may still face a learning curve in optimising the system for best results.

Pricing:

Nanonets caters to individuals, freelancers, consultants and businesses of all sizes with their pricing plans. They offer a one-time trial where you can process up to 500 pages for free. Beyond that, the pricing plans are tiered.

- Pay-as-you-go plan: Charged at USD 0.3/page for data extraction and USD 0.05/step for a workflow step.

- Pro plan: Charged at USD 999/month for extracting data from up to 10,000 pages.

- Enterprise plan: Custom-priced based on number of pages needed, customisation steps, integrations, etc.

2. Freshbooks

FreshBooks is a popular accounting software, but it also offers features for bank statement processing and data extraction, although it’s not its core focus. The platform allows users to connect their bank accounts and credit cards directly, automatically importing transactions for easier reconciliation.

FreshBooks can categorise transactions based on predefined rules, reducing manual data entry. While it doesn’t offer advanced OCR for scanning physical bank statements, it does provide a user-friendly interface for reviewing and categorising imported transactions.

The software’s ability to generate financial reports based on bank data can be helpful for small businesses and freelancers. However, for complex varying formats or high-volume bank statement processing, FreshBooks may not be as robust as a few other modern-day IDP solutions.

Key features:

1. Automatic bank transaction import

2. Rule-based transaction categorisation

3. Basic reconciliation tools

4. Financial report generation

✅

1. User-friendly interface

2. Integrates bank data with other accounting features

3. Suitable for small businesses and freelancers

❗

1. Limited OCR capabilities for physical or scanned bank statements

2. May not be able handle complex or high-volume statement processing well

3. Not specialised for bank statement extraction, can handle bank statement reconciliation but not other workflows

Pricing:

FreshBooks offers three standard pricing plans:

- Lite plan starting from $19/month

- Plus plan starting from $33/month

- Premium plan starting from $60/month

However, these prices are for the overall accounting software, not specifically for bank statement extraction features. All plans include bank connections and transaction imports, but the number of billable clients and additional features vary by plan. It’s worth noting that FreshBooks occasionally offers discounts, especially for annual subscriptions.

3. ParseSoft

This software focuses on making your transaction files or bank statements compatible to be imported into your accounting software, format-wise. As a result, it offers great flexibility when it comes to the varying formats available for conversion.

It offers features for handling multiple statements at once. You can combine them or keep them separate. You can rename these statements based on predefined rules and assign categories to them. It also allows editing your bank statements during conversion.

Key Features:

- Supports formats like, PDFs, Images, Text, Excel, CSV, as well as accounting software file formats, like OFX, QFX, QBO, QIF/QMTF, MT940/STA.

- Offers integrations with Quickbooks, Quicken, Sage, Xero, Wave, Excel, Google Sheets among others.

- Offers powerful renaming and categorizing features.

- Allows editing bank statements during conversion.

- Has multiple date and time formatting options.

✅

1. Supports multiple formats for imports and exports

2. Offers offline licenses, meaning it can be installed locally on devices reducing internet-dependency.

3. Offers a lifetime license where you pay once for access to the software, which makes it cost-efficient

❗

1. Complicated and obsolete user interface which lowers ease of use

2. Limited accuracy which, given the sensitive nature of bank statements, can lead to financial consequences

3. Lifetime licenses can be expensive for some users

Pricing:

Propersoft offers tiered pricing, in monthly, annual and lifetime license formats, the details to which are as follows:

- Monthly License: It costs $19.99 per month and includes access for unlimited pages/statements. It supports all converters and apps and offers free updates.

- Yearly License: It costs $119.99 per year. and includes access for unlimited pages/statements. It supports all converters and apps and offers free updates.

- Lifetime License: It costs $199.99 as a one-time payment. It includes access for unlimited pages/statements, for all converters, formats, apps, and offers updates every 12 months.

4. DextPrepare

DextPrepare is a comprehensive financial management tool designed to simplify expense management, especially for accountants and small to medium-sized businesses.

One of its standout features is its bank statement extraction capability, which can be used to automatically capture and categorise data from bank statements with high accuracy.

Although this is not a focus feature for them, this functionality streamlines the bank statement reconciliation process and reduces manual data entry. The software supports integration with various accounting platforms, enhancing workflow efficiency.

Key Features:

- Automated data capture and categorisation from bank statements.

- Handles receipts, invoices, and bills alongside bank statements.

- Seamless integration with major accounting software like QuickBooks, Xero, and Sage.

- Offers a mobile application to capture documents and manage expenses on the go.

- Handles transactions in different currencies.

✅

Pros:1. Handles complex and varied bank statement formats2. Scalable for high-volume processing3. Continuous learning and improvement of extraction accuracy4. Robust data security measures

❗

Cons:1. May require initial setup and training for optimal performance2. Pricing may be higher compared to basic accounting software and can be significant for small businesses and startups

Pricing:

DextPrepare is primarily targeted at Accounting and bookkeeping firms. It offers two plans that can be billed monthly or annually. Annual plans can help you save up to 13% on subscription costs. Below are the monthly rates:

- Dext Essentials: USD 229.99 per month. Allows you to have upto 10 clients, with unlimited users each. You get access to all features, excluding premium features, like, PDF AutoSplit, or data insights.

- Dext Advanced: USD 247.23 per month. Allows you to have upto 10 clients, with unlimited users each with access to entire feature-suite.

Users also get the option to build a custom plan for themselves.

5. Infrrd

Infrrd, is an AI-powered Intelligent Document Processing (IDP), that offers solutions for data extraction, including pre-trained extractors for bank statement processing. It leverages artificial intelligence and machine learning to automate the extraction and categorisation of financial data from various bank statement formats. It is designed to handle complex, unstructured data, transforming it into actionable insights.

With the pre-trained bank statement extractor, their system can extract transaction details, account information, and other relevant financial data, significantly reducing manual data entry and processing time.

Key features:

1. Automated extraction of transaction details (dates, descriptions, amounts)

2. Intelligent categorisation of transactions

3. Support for multiple bank statement formats and layouts

4. Integration capabilities with financial software and ERPs

5. Customisable extraction rules to meet specific business needs

✅

1. High accuracy rates in data extraction, reducing manual errors

2. Ability to process large volumes of statements quickly

3. Significant time savings compared to manual processing

4. Handles complex and varied statement formats

5. Customisable to specific business requirements

❗

1. May require initial setup and configuration time

2. Potential challenges with very non-standard or poorly scanned documents

3. Ongoing costs for software licenses or API usage

4. May require human verification for ambiguous data points

Pricing:

Infrrd typically offers custom pricing based on specific client needs and processing volumes.

They have 3 standard tiers:

- Basic: Custom-priced. Offers features like advanced pre-processing, automated auditing and flagging of inaccurate extractions, easy API integrations, etc.

- Enterprise: Custom-priced. Offers all basic features and in addition, offers dedicated support and performance-based pricing options.

- Enterprise Plus: Custom-priced. Ensures 100% accuracy and other features, like, accelerated processing, custom dashboards, etc.

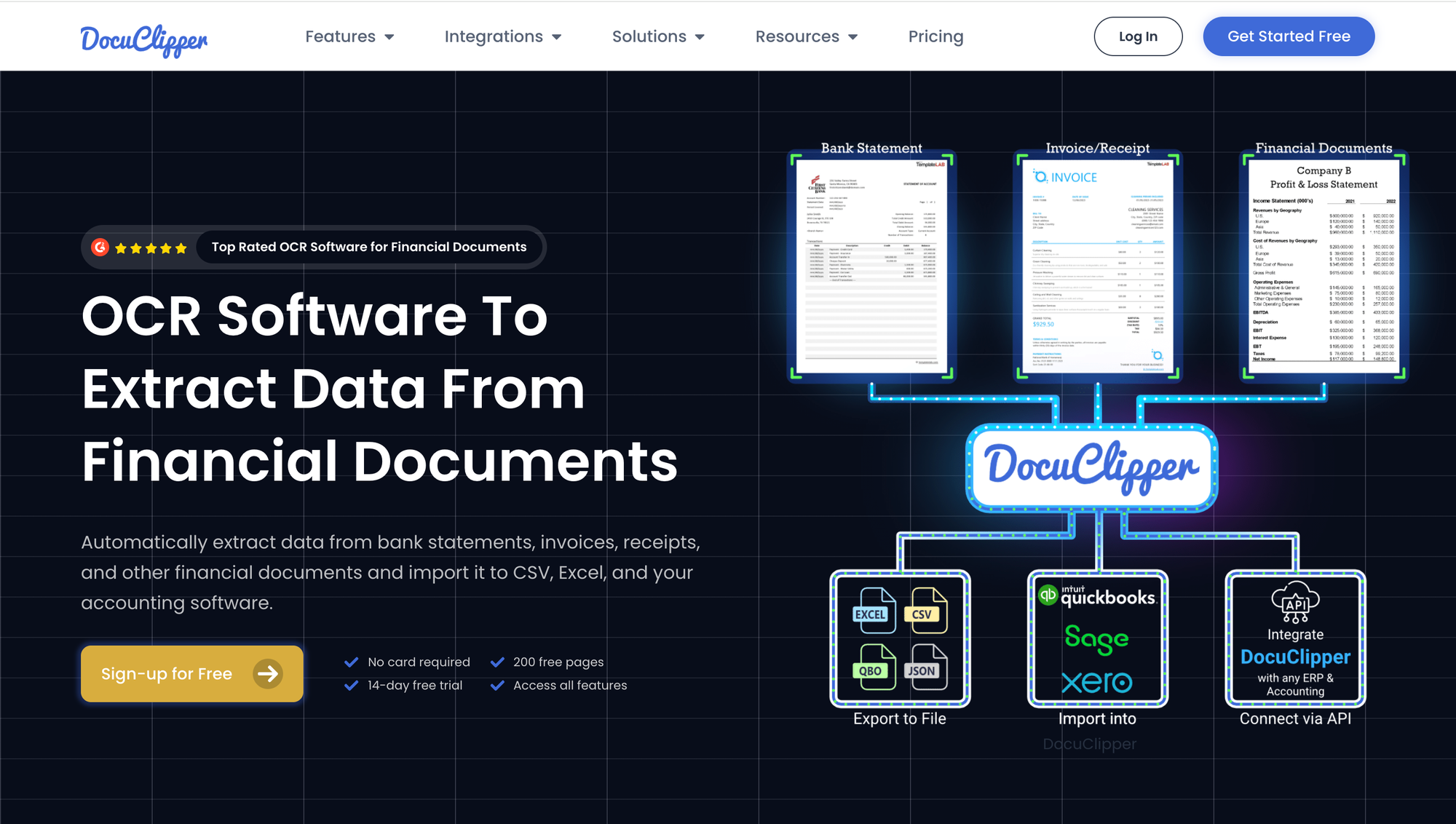

6. Docuclipper

Docuclipper, designed specifically for document data extraction, performs well in bank statement processing. Unlike general accounting software, Docuclipper focuses on automating the extraction of transactions, balances, and other relevant financial information from both digital and scanned bank statements of varying formats. It is reliable for high-volume and complex extractions from bank statements. Its ability to export data into popular accounting software or spreadsheets simplifies the workflow for businesses.

Key features:

1. Advanced OCR technology for digital and scanned bank statements

2. Automatic extraction of transactions, balances, and other relevant financial data points from varying formats

3. Export options to accounting software or spreadsheets

✅

1. Optimised for bank statement extraction

2. Handles complex and high-volume documents

3. Integrates with accounting tools and data formats

Pros:

❗

1. Specialised for document extraction, not a full bank statement reconciliation solution

2. May require setup for some custom formats

Pricing:

Docuclipper offers tiered pricing based on the number of pages processed, making it scalable for businesses of different sizes.

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month.

7. Parseur

Parseur is a versatile document parsing tool that can extract data from bank statements with its template-based approach. It also has an AI-powered custom extractor that can be trained to capture transaction details, balances, and account information from both digital and scanned bank statements.

It can automatically extract and categorize the data, which can then be exported to various accounting platforms or spreadsheets. Users can send in their bank statements via email or upload them manually.

Parseur’s strength lies in its flexibility and ease of use for non-technical users, making it suitable for businesses with diverse document processing needs. The accuracy for bank statements, especially of varying formats is limited, as are the available options for importing and exporting your bank statements and extracted data respectively.

Key Features:

- OCR-powered data extraction for bank statements

- Customisable templates for different formats

- Easy export to accounting tools, CSV, and spreadsheets

✅

1. Easy to set up and use, even for non-technical users

2. Supports a wide variety of bank statement formats

3. Flexible template creation for specific needs

❗

1. Template creation may require initial setup time

2. Need to create templates for every different format limiting scalability

3. Not as accurate for complex layouts, like nested tables, multi-line descriptions, etc.

4. Limited import and export options

Pricing:

Parseur offers two types of plans when it comes to pricing. They offer a free plan that allows users to process 20 documents per month. Paid plans are as follows:

- Micro: USD 39/month for up to 100 pages.

- Mini: USD 69/month for up to 300 pages.

- Starter: USD 99/month for up to 1,000 pages.

- Premium: USD 199/month for up to 3,000 pages.

- Pro: USD 299/month for up to 10,000 pages.

For volumes higher than 10,000 pages per month, the pricing becomes custom.

8. Parsio

Parsio offers automated data extraction capabilities for various document types, including bank statements. While not exclusively focused on bank statement processing, Parsio’s platform can be configured to extract data from bank statements using custom parsing rules. Users can set up templates to identify and extract specific fields such as transaction dates, descriptions, amounts, and balances from recurring statement formats.

The system utilises OCR technology to process both digital PDFs and scanned documents. Once extracted, the data can be exported to various formats like CSV or JSON, or integrated with other systems via API. Parsio’s approach to bank statement extraction is flexible but may require more manual setup compared to specialised banking extraction tools.

Key features:

1. Custom parsing rules for data extraction

2. OCR capabilities for scanned documents

3. Template creation for recurring document formats

4. Multiple export options (CSV, JSON, etc.)

5. API integration for automated workflows

6. Support for various document types beyond bank statements

✅

1. Flexible system adaptable to different statement formats

2. One-time setup for recurring statement layouts

3. Handles both digital and scanned documents

4. Integrates with other business systems via API

❗

1. May require more manual configuration than specialised bank statement tools

2. Accuracy depends on the quality of user-created parsing rules

3. Not specifically optimised for financial data extraction

4. May lack advanced features like automatic transaction categorisation

Pricing:

Parsio offers a tiered pricing model:

1. Free plan: Up to 100 credits/month

2. Starter plan: $49/month for up to 1,000 credits

3. Growth plan: $149/month for up to 5,000 credits

4. Business plan: $249/month for up to 12,000 credits

A single credit allows you to parse data from a single email/image/document. All paid plans include features like OCR, API access, and integrations, with higher tiers offering more pages per month and additional features like priority support.

9. Super.AI

Super.AI offers a flexible AI-powered document processing platform that can be adapted for bank statement extraction, though it’s not exclusively focused on this task. The platform leverages machine learning and computer vision technologies to automate data extraction from various document types, including bank statements.

Users can train custom models to recognise and extract specific fields like transaction dates, descriptions, amounts, and balances from different statement formats. Super.AI’s system can handle both digital PDFs and scanned documents, using OCR when necessary. The extracted data can be validated against predefined rules and exported in various formats or integrated with other systems via API.

Key features:

1. Custom AI model training for specific document layouts

2. OCR capabilities for handling scanned documents

3. Flexible data extraction rules

4. Human-in-the-loop option for quality assurance

5. API integration for automated workflows

6. Support for various document types beyond bank statements

7. Data validation and cleansing tools

✅

1. Highly customisable to fit specific bank statement formats

2. Combines AI with human verification for improved accuracy

3. Scalable for high-volume document processing

4. Adaptable to various document types and layouts

❗

1. May require significant initial setup and training for optimal performance

2. Not a specialised solution for bank statement processing

3. Potential learning curve for non-technical users

4. Pricing may be higher compared to more focused solutions

Pricing:

Super.AI does not publicly disclose detailed pricing information. Their pricing model is typically based on the following factors:

1. Annual Volumes of documents to be processed

2. Desired data fields for extraction

- Customisation or training requirements

10. CaptureFast

CaptureFast offers document processing capabilities that include bank statement extraction as part of its broader intelligent document processing platform. The system uses advanced OCR and machine learning algorithms to automate data extraction from various bank statement formats.

CaptureFast can identify and extract key financial data such as transaction dates, descriptions, amounts, and account balances from both digital and scanned bank statements. The platform allows for the creation of custom templates to handle different statement layouts from various financial institutions.

Once extracted, the data can be validated, categorised, and exported to various financial systems or formats for further analysis and reporting.

Key features:

1. Automated data extraction from multiple bank statement formats

2. Custom template creation for different statement layouts

3. OCR capabilities for processing scanned documents

4. Data validation and categorization tools

5. Integration with financial software and ERP systems

6. Support for other financial documents beyond bank statements

7. Cloud-based solution with secure data handling

✅

1. Flexible system adaptable to various bank statement formats

2. High accuracy rates for data extraction

3. Scalable for businesses of different sizes

4. Reduces manual data entry and associated errors

5. Integrates well with existing financial workflows

❗

1. May require initial setup and training for optimal performance

2. Not exclusively focused on bank statement processing

3. Potential learning curve for complex customizations

4. Pricing may be higher for small businesses with low volume needs

Pricing:

CaptureFast offers a tiered pricing plan:

- Free: Users get 100 pages/month free of cost.

- Basic: USD 69/month for 1,000 pages per month.

- Professional: USD 299/month for 10,000 pages per month.

- Business: USD 799/month for 30,000 pages per month.

- Custom: Custom-priced based on a combination of features and volume of pages.

- Enterprise: Custom-priced for organisations that want on-premise deployment.

The list of features included in each plan varies.

How to choose the right bank statement OCR software for yourself?

Choosing the right bank statement extraction software can be crucial for managing finances efficiently. Here’s a step-by-step guide to help you make an informed decision:

1. Identify Your Needs

Identifying and documenting your needs is the crucial first step when selecting a software. It can vary based on your role. For instance, if you are a bookkeeping firm or a freelance tax consultant, your needs would vary from that of an enterprise looking to automate their bank statement reconciliation process. This would, in turn be different from an insurance startup looking to automate their customer onboarding/KYC process.

Here are a few factors to consider.

- Volume: Estimate how many bank statements you need to process regularly. High-volume users may need more robust solutions.

- Data Accuracy: Consider how critical accuracy is for your needs. If precise data capture is essential, look for software with advanced OCR (Optical Character Recognition) technology.

- Integration Requirements: Determine if you need the software to integrate with your existing accounting or financial management systems, such as QuickBooks, Xero, or Sage.

2. Shortlist a few vendors and evaluate them

This is where we come in. With our curated list, you will find a bank statement extraction software for every need. Refer to the list above and shortlist a few vendors who you think can help you automate your process, specific to your needs. Here are a few factors to consider:

- Accuracy: Is the vendor specialised in bank statement extraction? What is the accuracy they provide? Can they support multiple languages and formats?

- Setup Process: How long after purchase can you start using the software? Are the features you are looking for ready-to-use or require customisation? Can you make changes easily? Is it secure?

- User Experience: Is it user friendly? Can the non-technical team members use the software comfortably?

- Pricing: What is the average market price for the feature-suite I am looking for? What is the billing cycle (Monthly/Quarterly/Annually)? Does it fit my budget?

Most of these software have a free trial period or options to request a custom demo. Test it thoroughly before making a purchase. You can also reach out to a few peers to gather feedback or look at review platforms online.

3. Make an Informed Decision

Once you have all the information you need, it is time to make an informed decision.

- Weigh Pros and Cons: Compare the software options you’ve considered, focusing on how well they meet your needs.

- Long-Term Considerations: Think about how the software will meet your needs in the future as your business grows or your document volume increases.

By following these steps, you can select bank statement extraction software that not only fits your current needs but also supports your long-term financial management goals.