Accounts payable is a crucial aspect of financial management that every business owner and finance professional must understand. Put simply, accounts payable refers to the money a company owes its suppliers for goods or services purchased on credit.

Effectively managing accounts payable is essential for maintaining healthy cash flow, fostering strong vendor relationships, and ensuring the overall financial well-being of your organization.

A McKinsey report illustrates this point with a compelling example. In one company, an audit of its accounts payable revealed missing items and duplications—so much so that the procurement managers had underestimated the company’s total spend with some suppliers by up to 90%. Think about the discounts and savings opportunities they were missing out on!

Over the course of this article, we’ll help you understand everything you need to know about accounts payable, exploring its definition, the AP process, best practices, and how to automate the AP cycle.

What is accounts payable?

Accounts payable (AP) is a term used in accounting to describe the money a company owes to its suppliers or vendors for goods or services purchased on credit. When a company buys products or services from a vendor with an agreement to pay later, the amount owed is recorded under the accounts payable account, a current liability on the company’s balance sheet.

The accounts payable process involves receiving invoices, verifying their accuracy, recording them in the accounting system, and eventually paying the amount due. In a nutshell, accounts payable represents the money a company must pay out to its suppliers in the near future, typically within 30 to 90 days.

The account payable is recorded when an invoice is approved for payment. It’s recorded in the General Ledger (or AP sub-ledger) as an outstanding payment or liability until the amount is paid. The sum of all outstanding payments is recorded as the balance of accounts payable on the company’s balance sheet. The increase or decrease in total AP from the previous period will be recorded in the cash flow statement.

Effective accounts payable management is crucial for maintaining a healthy cash flow and avoiding late payment penalties.

Examples of accounts payable expenses

Here are a few examples of accounts payable expenses:

- Inventory and raw materials: Think of all the items you need to create your products, like steel, fabric, and plastics.

- Office supplies and equipment: From pens and paper to computers and printers.

- Utilities: Electricity, gas, water, and other bills that you need to pay to keep the business operational.

- Professional services: Includes fees paid for legal advice, consulting, or accounting help.

- Rent and lease payments: If you don’t own your office or retail space, rent is a significant account payable expense.

- Travel expenses: Airfare, hotels, and meals when you or your employees travel for work.

- Repairs and maintenance: From fixing a damaged laptop to maintaining your office’s HVAC system.

- Subscription services: From MS Office 365 subscriptions to server hosting charges, all the monthly or annually recurring payments for digital services.

- Freight and shipping costs: Postage, courier services, or freight charges billed by the shipping provider.

Save 70% on invoicing costs!

“Tapi has been able to save 70% on invoicing costs, improve customer experience by reducing turnaround time from over 6 hours to just seconds, and free up staff members from tedious work.” – Luke Faulkner, Product Manager at Tapi.

Schedule a personalized demo with us to learn how our AP automation solution can transform your accounts payable process and drive significant cost savings for your business.

The accounts payable process

The AP cycle covers the entire lifecycle of a company’s payment obligations, from the initial purchase to the final payment and reconciliation. The cycle starts when a department within the company initiates a purchase request. Once approved, a purchase order (PO) is issued to the vendor.

Upon delivery, the receiving team checks the items against the PO. The vendor then sends an invoice. This is where the accounts payable process truly begins.

Let’s break down the steps involved:

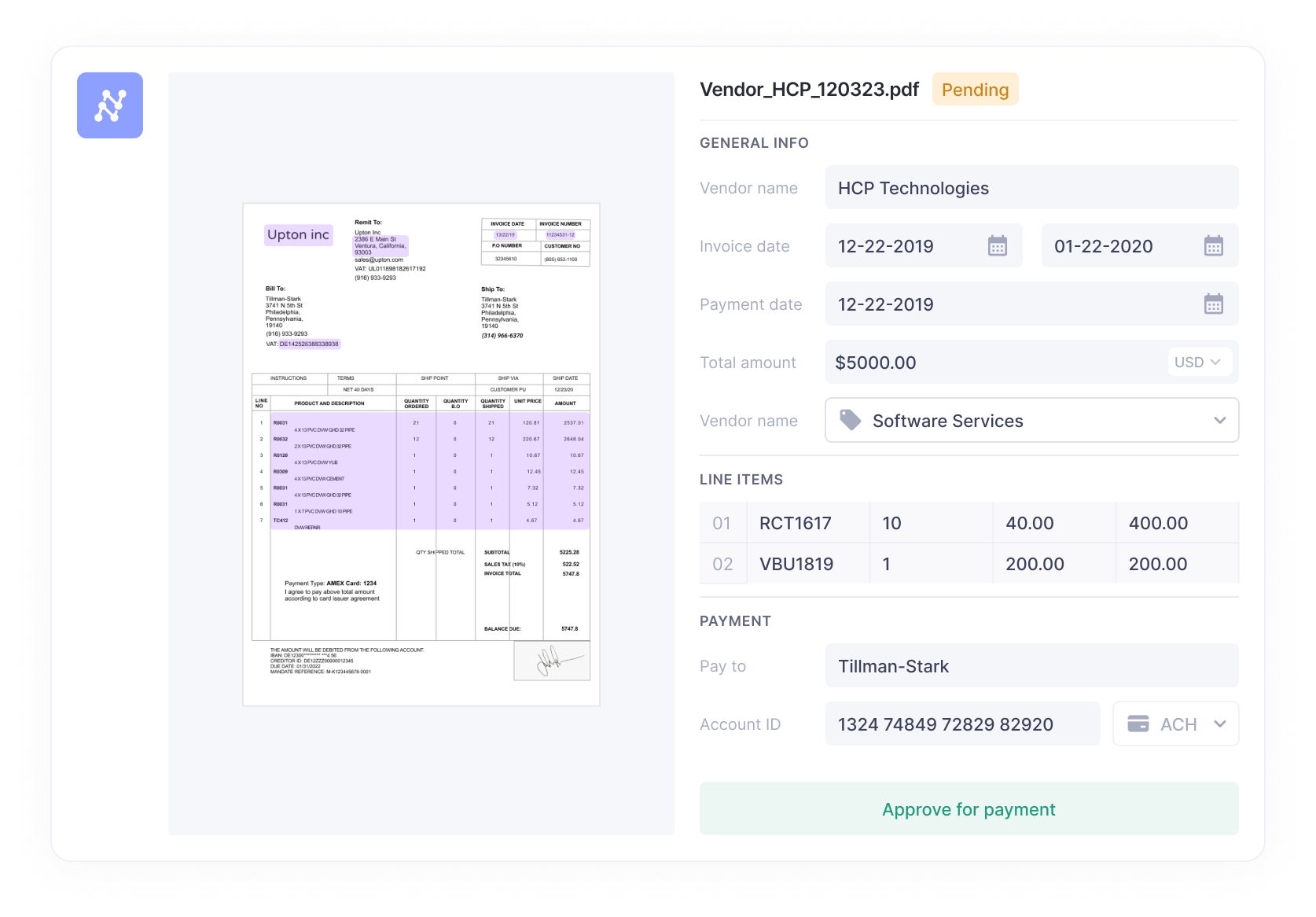

Invoice receipt and verification: The vendor may send the invoice to the AP department via email, physical mail, or an electronic invoicing system. The AP team then verifies it for accuracy, checking details like the vendor name, invoice number, date, and amount. This step is vital to prevent errors or fraud.

Invoice data entry and GL coding: After verification, the invoice details are entered into your accounting system and assigned appropriate General Ledger Codes (GL Codes). These unique alphanumeric codes help categorize transactions to the correct general ledger accounts, such as office supplies, utilities, or raw materials.

Three-way matching and approval: The AP team performs a three-way match, comparing the invoice against the PO and goods receipt note. This is to ensure you’re paying for exactly what you ordered and received. Once matched, the invoice goes through your company’s approval workflow, which may involve multiple levels of approval depending on your policies.

Payment processing and execution: After approval, the invoice is scheduled for payment according to the terms. This involves issuing a check, initiating an ACH transfer, or using a company credit card. It’s important to keep track of payment dates to avoid late fees and maintain good vendor relationships.

Record keeping: Finally, the transaction is recorded in your financial system. The AP team reconciles this transaction in their monthly close process and includes it in their report on outstanding payables. The invoice is then archived for future reference or audits. This systematic approach ensures accurate record-keeping and helps maintain a clear audit trail.

Throughout the AP cycle, companies may also employ various internal controls and approval workflows to ensure the integrity and efficiency of the process. These controls may include segregation of duties, invoice matching, and regular audits to detect and prevent errors or fraud.

How AP automation works

Automated invoice processing saves companies 77%, reducing costs from $6.30 to $1.45 per invoice. Automated AP software streamlines the entire accounts payable process by leveraging advanced technologies such as artificial intelligence, optical character recognition, and machine learning.

Let’s take a look at the process:

- Capture invoices: AP automation systems can automatically capture invoices from various sources, such as email inboxes, cloud storage, or direct integrations with vendor portals. This eliminates the need for manual data entry and reduces the risk of errors.

- Extract data: Once the invoices are captured, the system uses powerful OCR and AI to extract relevant data from the invoices. This includes vendor details, invoice numbers, due dates, line items, and total amounts. The extracted data is then validated against predefined rules to ensure accuracy.

- Automate workflows: Set up custom workflows based on your organization’s specific requirements. For example, you can define approval hierarchies, set up automatic routing for different invoice types and reminders to approvers, and configure rules for exception handling. This ensures that invoices are processed efficiently and consistently, reducing processing times and improving overall productivity.

- Integrate data: Automatically export and sync to your existing ERP, accounting software, and other business systems. This allows for smooth data flow and eliminates the need for manual data entry across multiple systems. With real-time sync, you can ensure that your financial data is always up-to-date and accurate.

- Process payments: Once invoices are approved, you can schedule payments according to due dates and cash flow needs. Then, generate payment files, integrate them with your bank or payment gateway, and automate the reconciliation. This ensures timely payments to vendors and maintains strong supplier relationships.

Companies with fully automated AP processes handle more than double the workload. They process 18,649 invoices per full-time employee annually, compared to just 8,689 for those relying on manual methods.

Automate bill pay with Nanonets

Never chase an invoice again!

Set up touchless AP workflows with Nanonets. Automate data capture, build custom workflows, and streamline the accounts payable process in seconds—no code is required. See how you can slash AP costs and eliminate manual errors. Book a personalized demo today.

Here’s a quick comparison between automated AP and manual AP workflows:

| Process | Automated AP | Manual AP |

|---|---|---|

| Invoice Processing | Fast, accurate data capture using OCR | Slow, error-prone manual data entry |

| Matching | Automated three-way matching | Time-consuming manual comparison |

| Approval Routing | Intelligent, rule-based routing | Manual email or paper-based routing |

| Payment Scheduling | Automated based on terms | Manual tracking and scheduling |

| Reporting | Real-time, detailed analytics | Limited, time-consuming manual reports |

| Error Rate | Low, with built-in validation | Higher risk of human error |

| Processing Time | Minutes to hours | Days to weeks |

| Cost per Invoice | Lower, typically $1-$5 | Higher, often $10-$30 |

What is the role of AP in accounting?

AP is recorded as a current liability on the balance sheet. When a company receives goods or services on credit, it creates an AP entry by debiting the relevant expense or asset account and crediting Accounts Payable.

When the invoice is paid, this entry is reversed: Accounts Payable is debited, and Cash or Bank Account is credited. This double-entry system ensures that the company’s books remain balanced and accurately reflect its financial position.

AP vs. AR

While Accounts Payable represents money owed by a company, Accounts Receivable (AR) represents money owed to a company by its customers. The key differences are:

- Balance sheet position: AP is a liability; AR is an asset.

- Cash flow impact: AP decreases cash when paid; AR increases cash when collected.

- Financial goals: Companies aim to extend AP terms while reducing AR collection times.

AP vs. Trade Payable

While often used interchangeably, AP and Trade Payables have subtle differences:

- Scope: AP includes all short-term debts owed to creditors, while Trade Payables specifically refer to amounts owed to suppliers for goods or services directly related to the company’s core business.

- Financial reporting: Some companies may separate Trade Payables from other payables on their balance sheet for more detailed reporting.

- Usage: Trade Payables are often used in financial ratios specific to supplier relationships and inventory management.

What does the AP department do?

The accounts payable department manages a company’s financial obligations to suppliers and service providers. Its core functions include invoice management, payment processing, supplier relations, financial record-keeping, and policy compliance.

These responsibilities are typically distributed among various roles such as AP clerks, payment processing analysts, exceptions analysts, vendor management specialists, and AP managers.

AP professionals in small businesses often handle multiple roles and juggle many responsibilities simultaneously.

Here are some of the common responsibilities handled by accounts payable:

- Collecting, maintaining, verifying, recording and sharing business transactions.

- Flagging invoices or transactions.

- Getting requisite approvals or signatures for particular transactions

- Creating a paper trail for each payment and reconciling bank statements.

- Veryfing invoices and payments by matching them or reconciling them with supporting documents.

- Review line items and totals on invoices to prevent fraud, errors & double payments.

- Keeping track of master vendor data, assigning voucher numbers, and maintaining vendor correspondences.

- Communicate accounting and spend policies with the company and large.

- Prepare a system of checks and balances.

Organizations, on rare occasions, also outsource AP functions to external agencies.

How to monitor your AP efficiency?

Always measure your company’s AP process efficiency to identify areas for improvement. This will enable you to proactively identify cashflow issues and optimize working capital.

Keep an eye on these AP indicators to monitor and improve your AP process:

- Days Payable Outstanding (DPO): Measures the average number of days a company takes to pay its suppliers. A higher DPO can indicate better cash management but may strain supplier relationships if too high. Formula: DPO = (Average Accounts Payable / Cost of Goods Sold) x 365

- Accounts Payable Turnover Ratio: Indicates how many times a company pays off its average accounts payable during a year. A higher ratio suggests the company is paying suppliers more quickly. Formula: AP Turnover Ratio = Cost of Goods Sold / Average Accounts Payable

- Percentage of Early Payments: Shows the proportion of payments made before the due date. This can indicate potential for capturing early payment discounts but may also suggest inefficient cash management. Formula: (Number of Early Payments / Total Number of Payments) x 100

- Percentage of Late Payments: Reflects the proportion of payments made after the due date. High percentages may indicate cash flow issues or inefficient processes. Formula: (Number of Late Payments / Total Number of Payments) x 100

- Invoice Processing Time: Measures the efficiency of the AP process from receipt to payment of an invoice. Shorter times generally indicate more efficient processes. Formula: Average time from invoice receipt to payment

- Invoice Exception Rate: Shows the percentage of invoices that require manual intervention. A high rate may indicate issues with supplier invoicing or internal processes. Formula: (Number of Invoices Requiring Manual Intervention / Total Number of Invoices) x 100

- Cost Per Invoice: Measures the total cost of processing an invoice. Aim to keep it less than $3 per invoice. Formula: Total AP Department Costs / Total Number of Invoices Processed

- Cash Conversion Cycle (CCC): Measures how quickly a company converts investments into cash flows from sales. A lower CCC is better. Formula: DSO + DIO – DPO

- Working Capital as a Percentage of Revenue: Indicates how efficiently a company is using its working capital to generate revenue. A lower percentage typically indicates more efficient use of working capital. Formula: (Current Assets – Current Liabilities) / Revenue x 100

Regular tracking and analysis of these KPIs can provide valuable insights into the AP department’s functioning, pinpoint areas of concern, and highlight opportunities for improvement. These metrics allow businesses to streamline their AP processes, reduce errors, and improve vendor relationships.

Final thoughts

Accounts payable is a crucial function for any business. But why stop at manual processes when automation can revolutionize your AP department? By implementing AP automation, you can significantly reduce processing costs, minimize errors, and free up valuable time for strategic tasks.

Nanonets can streamline your entire AP process, from invoice capture to payment execution. This not only improves efficiency but also enhances vendor relationships and provides better visibility into your financial data. As businesses grow, the need for efficient AP automation becomes increasingly crucial.

Schedule a demo with us to see how Nanonets can transform your accounts payable process.

FAQs

What is the role of accounts payable?

Accounts payable manages a company’s outstanding debts to suppliers. Key responsibilities include processing invoices, ensuring accurate and timely payments, maintaining vendor relationships, preventing fraud, and optimizing cash flow. AP teams also handle expense reporting and compliance.

What’s the difference between accounts payable & accounts receivable?

Accounts payable is the money that your business owes to suppliers or vendors. Accounts receivable is the money that your customers owe to your business. The former represents outflows of cash while the latter describes inflows. Also, explore difference between accounts payable and notes payable.

What are the 4 functions of accounts payable?

The four main functions of the accounts payable department are:

- Receive, process, and verify invoices

- Authorize and schedule payments to vendors

- Maintain accurate records of transactions

- Manage vendor relationships (negotiate payment terms, resolve disputes, ensure timely payments)

Which type of account is accounts payable?

Accounts payable is considered a current liability account. This means it’s an obligation the company must pay off within the next year. Just like other liability accounts, accounts payable increases with a credit entry. When the company pays off the payables, it debits accounts payable. This type of account is crucial in managing cash flow and maintaining good relationships with suppliers.

How to calculate accounts payable?

If a business starts the year with $5,000 in accounts payable, makes $20,000 in credit purchases throughout the year, and makes payments of $15,000 to suppliers, the ending accounts payable would be:

Ending Accounts Payable = ($5,000 + $20,000) – $15,000

This means that the business has $10,000 in outstanding payables at the end of the year. Keeping track of this number helps businesses manage their cash flow and ensure they’re meeting their obligations to suppliers.

The full-cycle AP covers the complete accounts payable process, starting with purchase requisition and invoice generation and ending with final payment and reconciliation. This involves creating purchase orders, receiving goods, processing invoices, approving payments, executing transactions, and managing vendor relationships.

What are the steps in the accounts payable process?

- Invoice receipt

- Data entry and coding

- Verification and matching

- Approval routing

- Payment processing

- Payment execution

- Reconciliation and record-keeping

How is account payable treated in accounting?

Accounts payables are treated as a current liability on the balance sheet. They represent money owed to suppliers for goods or services received but not yet paid for. AP increases when invoices are received and decreases when payments are made.

How do you record accounts payable in accounting?

To record accounts payable:

- Credit the AP account when an invoice is received

- Debit the corresponding expense or asset account

- When paying, debit AP and credit cash

How do you record accounts payable in accounting?

When recording an invoice: Debit: Expense/Asset Account Credit: Accounts Payable

When paying an invoice: Debit: Accounts Payable Credit: Cash/Bank Account