IInvoice management software is transforming financial processes for businesses in 2024. If you’re looking to streamline your invoicing, you’re making a smart move that could save your company time and money.

Many businesses face challenges with invoice processing—from data entry errors to delayed payments. These issues can impact cash flow and overall efficiency. Fortunately, there’s a solution.

Modern invoice management tools automate much of the process. They can extract data from invoices, match them to purchase orders, route them for approval, and integrate with your accounting system. This automation can significantly reduce processing time and errors.

With numerous options available, choosing the right software for your needs can be challenging. That’s why we’ve created this guide to the top 10 invoice management solutions of 2024. We’ll compare features, pricing, and pros and cons to help you make an informed decision. Let’s get started.

What is Invoice Management Software?

An invoice management platform is designed to manage the invoicing process, including invoice creation, delivery, payment tracking, and reporting. By automating manual tasks, invoice management systems save time, reduce errors, and improve cash flow. They ensure timely, accurate payments, fostering better vendor relationships. Plus, they offer real-time visibility into your financial status, empowering you to make informed decisions.

At its core, invoice management software tackles these essential functions:

- Invoice capture: Automatically extracts data from incoming invoices, whether they’re paper, PDF, or electronic.

- Data validation: Checks for errors and inconsistencies, ensuring accuracy.

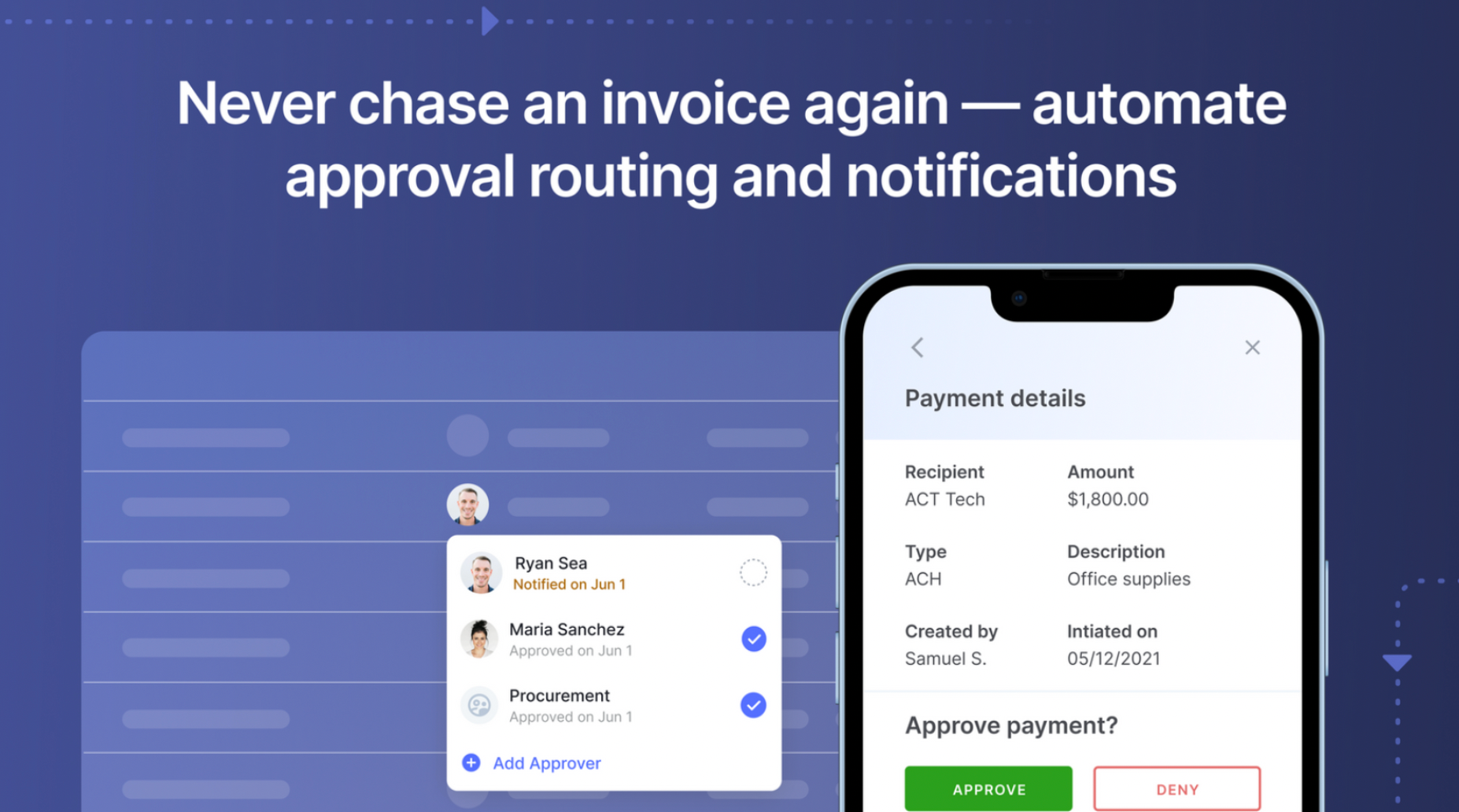

- Approval routing: Sends invoices to the right people for review and approval.

- Payment processing: Facilitates timely payments, often integrating with your existing financial systems.

- Reporting and analytics: Provides insights into your cash flow and spending patterns.

Invoice management systems aren’t just for large corporations. Businesses of all sizes can benefit from them. Ready to explore your options?

Best 10 Invoice Management Software for businesses in 2023

Invoice management software solutions come in all shapes and sizes, each with its unique strengths. We’ve done the legwork to help you find the best fit for your business.

Let’s look into the top 10 picks for 2024.

#1. Nanonets

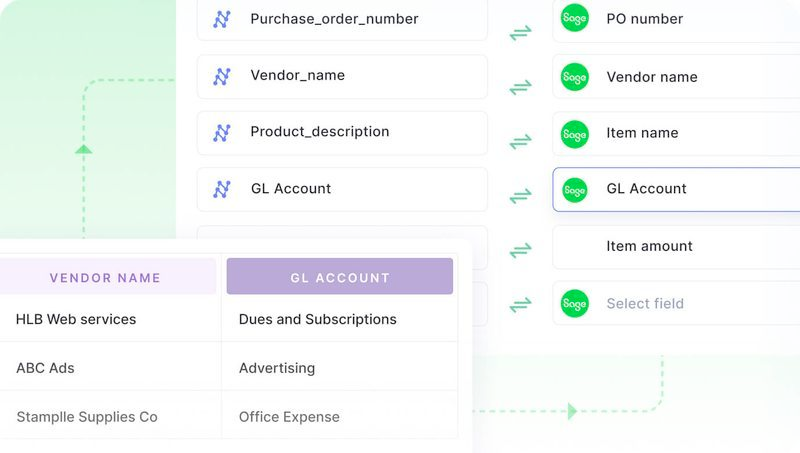

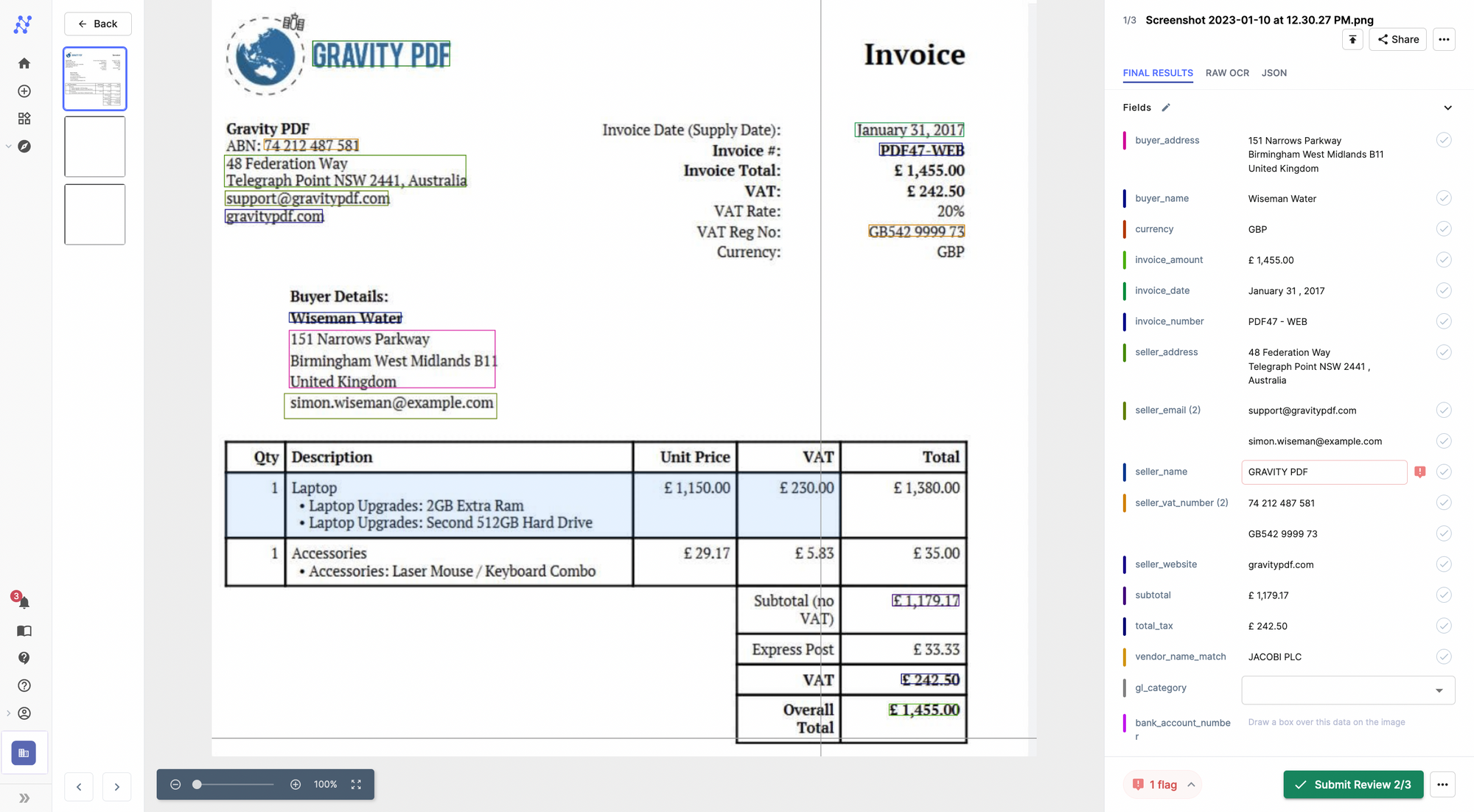

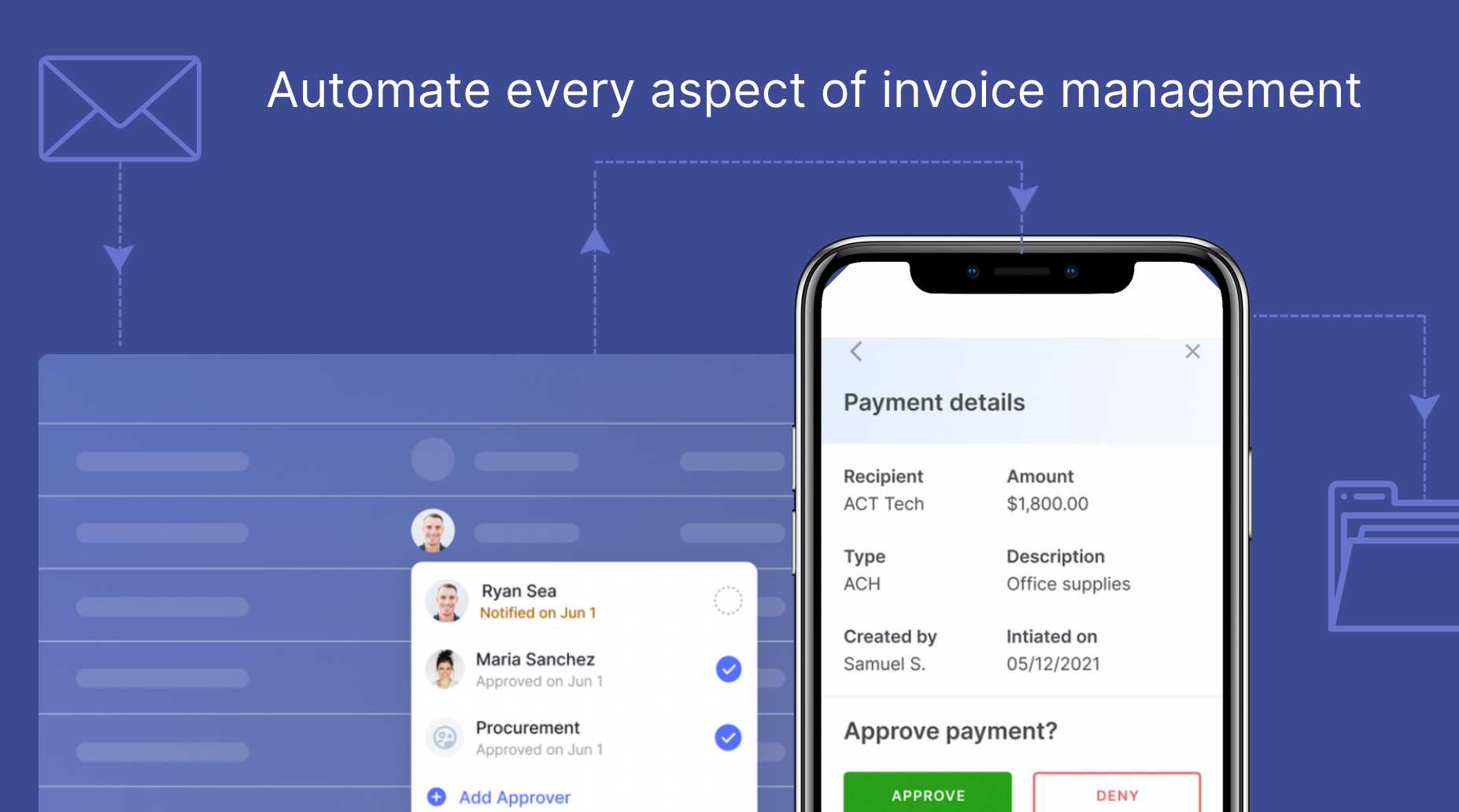

Nanonets is an all-in-one invoice management solution that streamlines invoice processing with intelligent automation. It offers built-in OCR, no-code workflows, a global payment platform, and 5000+ integrations that can automate data extraction, PO matching, invoice payments, reminders, invoice approvals, and more with little to no effort.

Top Features:

- The invoice OCR template extracts data from invoices with 95%+ accuracy.

- Reconcile invoices with 2, 3, and 4-way matching.

- Upload invoices from email, desktop, drive, or any other source automatically.

- Automatically update financial records in the balance sheet, general ledger, PnL, and more.

- Automate invoice approvals, invoice review, invoice payment reconciliation, and invoice payments with automated workflows.

- Classify all your invoices into different categories using a document classifier.

- Automate manual data entry processes using a workflow management system.

- Integrates with popular gateways for easy global payments

Pros:

Cons:

- Can’t generate invoices.

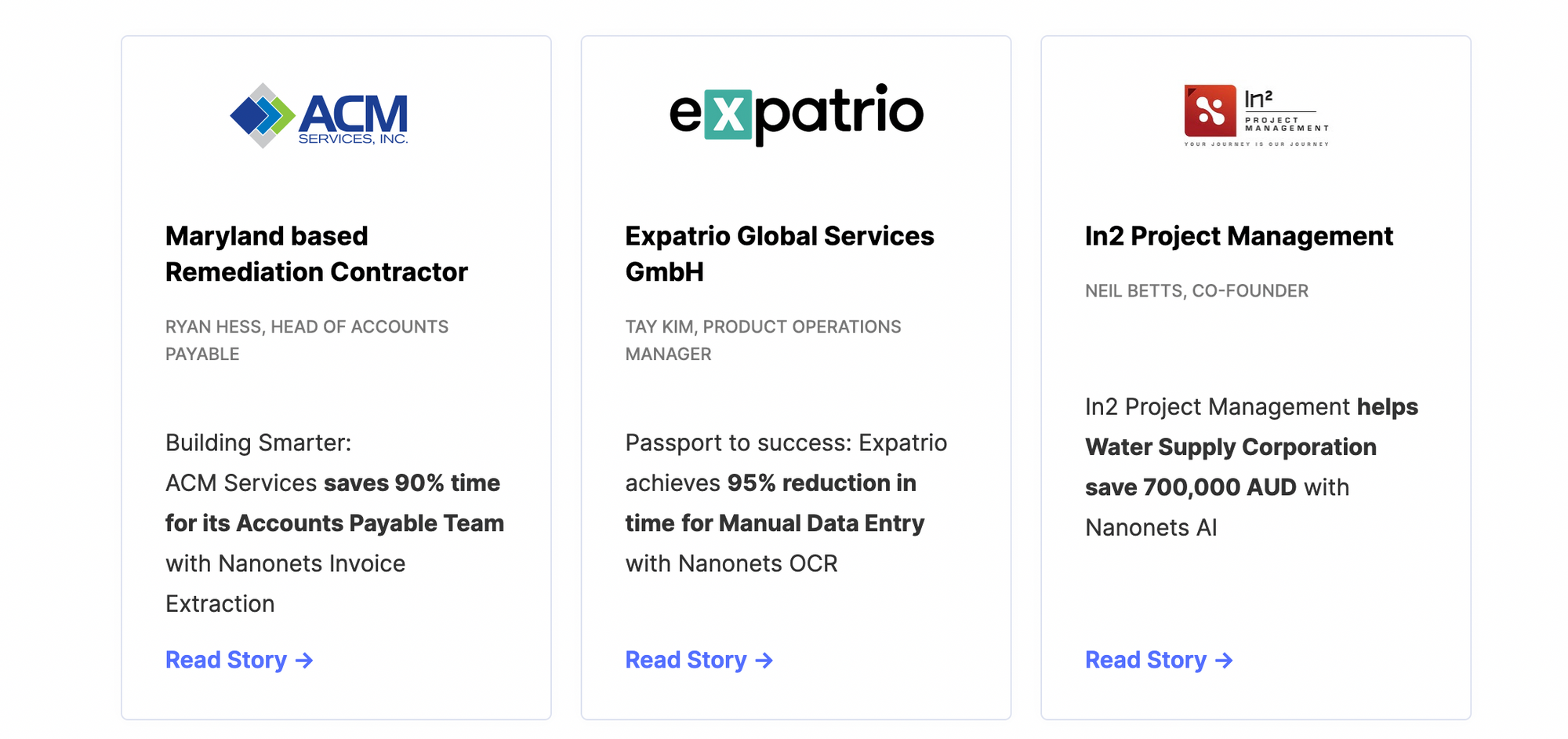

Here’s what customers say about Nanonets.

Rated 4.9 on Capterra and G2. Try Nanonets today. Start your free trial without any credit card details.

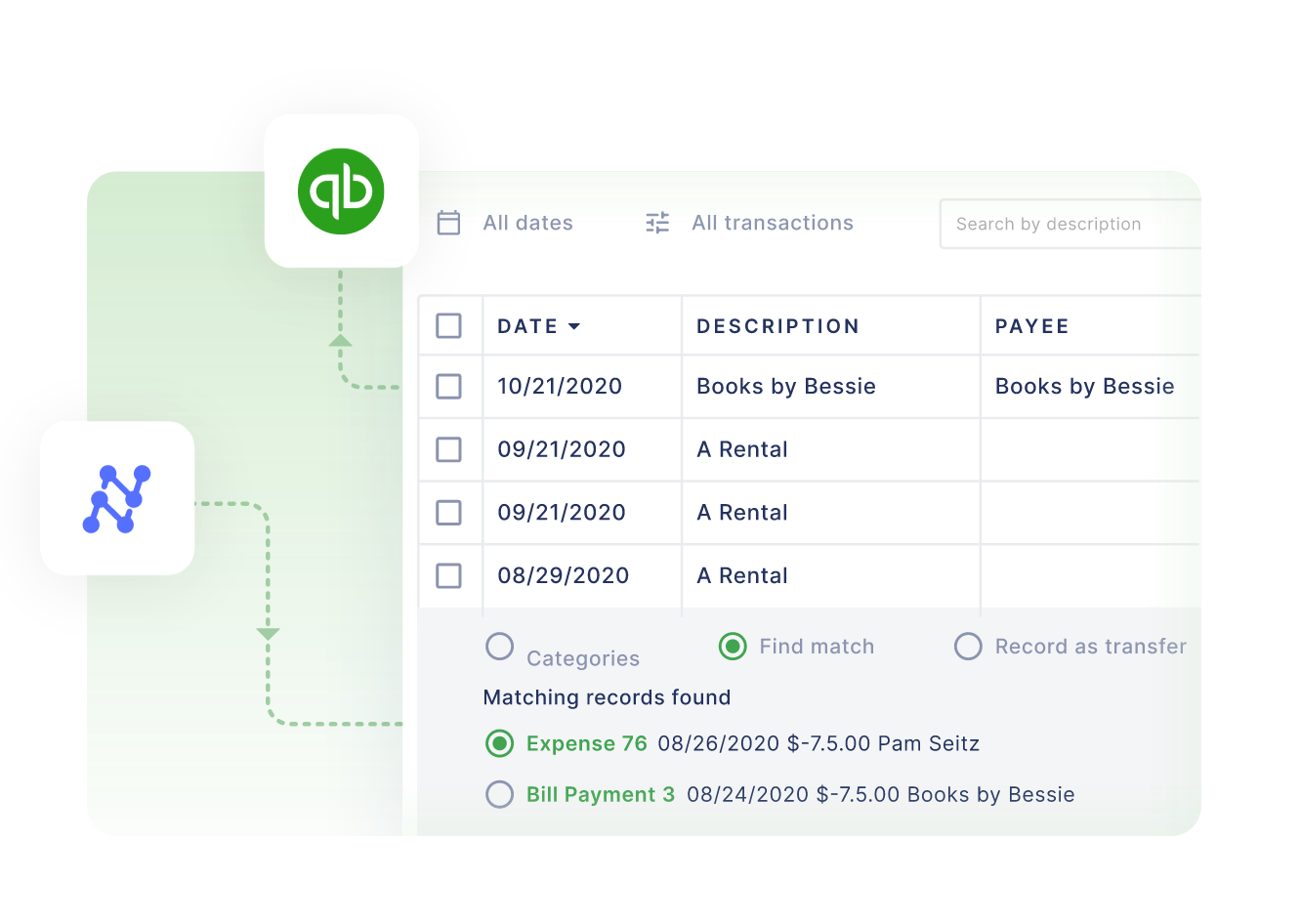

#2. QuickBooks Online

QuickBooks Online is a cloud-based accounting software that’s become a popular choice among many small to medium-sized businesses. It’s designed to simplify financial management, from basic bookkeeping to more complex accounting tasks.

Best for: Invoicing for small businesses

Top Features

- Generate professional-looking invoices using custom templates

- Send payment reminders for overdue invoices to customers

- Integrates with payment gateways for online payments

- Real-time financial reports.

Pros:

- Easy to use and intuitive interface

- Streamlines and simplifies invoice management processes

- Can provide valuable insights and data for decision making

Cons:

- Need a full subscription to use full features

- Customer support can be slow

- The subscription price is high and not flexible (Downgrading a plan is not possible)

- Data export is an issue

- The learning curve is steep, and need a lot of training to use the platform to its full potential

#3. FreshBooks

Freshbooks help small businesses organize their invoice and accounting processes from a single platform. FreshBooks allows users to create, send, track and pay invoices.

Top features:

- Automatically capture and tag expenses

- Easily create professional invoices (Removing branding is paid add-on)

- Easy to time track individuals

- Automatic invoicing

Pros:

- Reduces time spent on administrative tasks

- Easy to set up

Cons:

- Complicated for first-time users

- Integrations can be tricky

- Expensive as compared to other platforms

- Login page glitches frequently

- Reaching customer support is difficult

- No invoice processing automation

Use FreshBooks+Nanonets for end-to-end invoice automation. Generate invoices automatically from FreshBooks and process invoices using Nanonets. Automate invoices with both platforms.

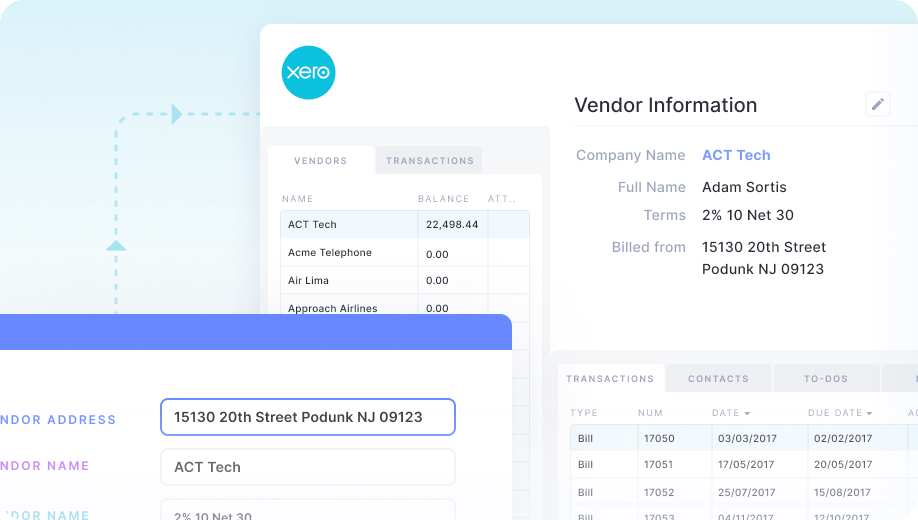

#4. Xero

Xero is a small business accounting software that handles all financial processes for accountants and bookkeepers.

Top features:

- Easy expense claims and reimbursement processes.

- Provides advanced financial analytics to track business progress.

- Easy invoice tracking features

- Secure platform

Pros:

- Good customer service

- Easy integrations

Cons:

- The workflow automation features are very basic

- Not very user-friendly for nonfinancial professionals

- Bank reconciliation is difficult

- Editing line items is difficult.

- Not best suited for complex financial processes

#5. Sage

Sage accounting automation software is designed to help small to medium-sized businesses track payments and expenses, send invoices, and calculate what they owe during tax season.

Top Features

- Create professional invoices

- VAT calculations are easy

- Easy invoice tracking features

- Supports multi-currency invoices

Pros

- Easy to use and setup

- 24×7 support (Paid customer support)

- Easy for non-accountants to use the platform

- Great user community

Cons

- Payroll is a separate product

- No time-tracking or collaboration tools

- fewer integrations

- Adding users is costly

- Outdated UI

- A downgrade is not possible

#6. SAP Concur

SAP Concur offers a robust invoice management solution as part of its comprehensive spend management platform. It’s designed to streamline the entire accounts payable process for businesses of all sizes.

💡

Pricing: Custom pricing based on business size and needs

Best for: Medium to large enterprises looking for a scalable, feature-rich invoice management system with strong automation capabilities.

Top Invoice Features:

• AI-powered invoice capture and data extraction

• Automated invoice matching and approval workflows

• Integration with major ERP systems

• Mobile app for on-the-go invoice approvals

• Vendor management portal

Pros for Invoicing:

- High accuracy in automated data capture

- Streamlined approval processes reduce invoice processing time

- Strong compliance and audit trail features

- Global currency and tax support

Cons for Invoicing:

- Can be complex to set up and configure

- Higher price point may not suit smaller businesses

- Occasional delays in processing

- Learning curve may be steep for new users

#7. BILL AP/AR

Bill offers a comprehensive invoice management platform designed for small to mid-sized businesses, streamlining both accounts payable and receivable processes.

➡️

Pricing: Custom pricing based on business size and needs

Best for: Medium to large enterprises looking for a scalable, feature-rich invoice management system integrated with travel and expense management.

Key Invoice Features:

- AI-powered invoice capture and data extraction

- Customizable approval workflows

- Integration with major accounting software (e.g., QuickBooks, Xero)

- International payments in multiple currencies

- Vendor management portal

Pros for Invoicing:

- User-friendly interface with intuitive navigation

- Efficient automated bill payment system

- Strong security measures, including fraud detection

- Mobile app for managing invoices on-the-go

Cons for Invoicing:

- Syncing issues with accounting software

- Limited customization options for invoice templates

#8. Tipalti

Tipalti offers an end-to-end accounts payable automation solution with strong invoice management capabilities, particularly suited for global businesses.

💡

Pricing: Custom pricing based on business needs

Best for: Mid-market to enterprise-level companies with complex invoicing needs, especially those dealing with global payments and multiple entities.

Key Invoice Features:

- AI-powered OCR for invoice data extraction

- Multi-entity and multi-subsidiary support

- Advanced approval workflows

- 3-way PO matching

- Built-in tax compliance for over 190 countries

Pros for Invoicing:

- Excellent for managing global payments

- Strong fraud detection and prevention features

- Seamless integration with major ERP systems

Cons for Invoicing:

- Can be complex for small businesses

- Implementation may require significant time investment

- Sync issues with accounting software

#9. Stampli

Stampli is an accounts payable automation platform that focuses on streamlining invoice processing and approval workflows. Its bot, Billy , learns from user behavior to automate coding and routing.

💡

Pricing: Custom pricing based on business needs

Best for: Small to large businesses looking to automate their entire AP process while maintaining existing ERP systems and improving cross-department collaboration.

Key Features:

- Intelligent data capture and extraction

- Centralized communication hub on each invoice

- Customizable approval workflows

- Integration with 70+ ERPs

- Advanced vendor management

Pros:

- Intuitive interface requiring minimal training

- Significantly reduces invoice processing time

- Strong audit trail and real-time visibility

- Flexible adaptation to existing AP processes

Cons:

- Sync issues with some ERPs

- Limited customization for certain fields

- Low OCR accuracy

#10. AvidXchange

AvidXchange is a comprehensive accounts payable automation platform designed for middle-market businesses, offering end-to-end AP and payment solutions.

💡

Pricing: Custom pricing based on business needs

Best for: Middle-market businesses looking for a comprehensive AP automation solution with strong payment capabilities and ERP integrations.

Key Features:

- AI-powered invoice capture and data extraction

- Customizable approval workflows

- Integration with 240+ accounting systems and ERPs

- Vendor payment portal with multiple payment options

- Robust reporting and analytics

Pros:

- Significantly reduces invoice processing time and paper usage

- Strong integration capabilities with major accounting systems

- Flexible approval workflows adaptable to existing processes

- Vendor self-service portal improves supplier relationships

- Comprehensive spend visibility and reporting

Cons:

- System outages and glitches

- Learning curve for advanced features and reporting

- Implementation can be complex for some organizations

Nanonets – The Best Invoice Management Platform

Nanonets is the perfect choice for businesses of all sizes looking to gain complete control over the invoice processing lifecycle.

Nanonets is an invoice management system that everyone can use, not just the finance team. Nanonets’ customizable platform allows organizations to use the platform for various use cases, including and not limited to

And more.

What makes Nanonets stand out?

Nanonets allow organizations to get a complete overview of their financial processes and automate them to increase the efficiency and productivity of teams. Automate manual, time-consuming tasks such as GL coding, approvals, vendor notifications, duplicate invoices, and more with no-code workflow automation. Nanonets also integrate with popular ERPs like Oracle, Sage Intacct, QuickBooks, and more for efficient data transfer.

Best-in-class OCR

Nanonets OCR software can extract data from invoices with 98%+ accuracy. With the pre-built invoice OCR model, you can start extracting invoice data as soon as you sign into the platform.

No-code workflow automation

Nanonets’ no-code workflow can automate manual data entry, transformation, enhancement, or transfer tasks.

Excellent Customer Support

Nanonets provides complete support at every step of the journey. Be it a technical or non-technical query, our team is here to help you to use Nanonets to their full potential for your organization. Nanonets provides 24×7 live customer support and free migration and training support.

Fully customizable platform

Have complex financial processes? Nanonets’ platform is entirely customizable to your needs.

Get started with Nanonets’ pre-trained invoice workflows or build your custom invoicing workflow. You can also schedule a demo to learn more about your use cases!

Here’s what customers say about Nanonets.

Rated 4.9 on Capterra and G2. Try Nanonets today. Start your free trial without any credit card details.

What are some of the features of Invoice Management Software?

While looking for the following invoice management software, you should keep these features in mind. An efficient invoice management software has the following features:

Invoice Processing

Invoice management software should allow you to process invoices easily. It should have OCR software that can perform invoice ocr in seconds and extract information accurately. It should also allow document data matching (PO matching) using the extracted data.

Payment Tracking

The software should allow users to track the status of invoices, including whether they have been paid or are overdue.

An invoice management system’s major benefit is automating manual aspects of invoice processes. The software should have workflow automation to automate data entry into ERPs, and accounting software, automate invoice approvals, invoice matching, GL coding, and data enhancements like updating currency fields or more.

Reporting and Analytics

The software should provide tools for generating reports and analyzing data. Visual reports to track invoice stages would help businesses get a correct idea about their cashflows.

Integrations

Any software you use should integrate with your existing business software. The software should be able to integrate with other business systems, such as accounting software, to streamline the invoicing process and avoid duplication of data entry.

Payment Processing

The software should have global payment gateways to allow global payments without leaving the platform.

Efficient Document Management

Invoices are essential documents that need to be handled with care. The invoice management system should have all features of a document management system to allow for secure storage of your document in case of an audit.

How to Choose Your Invoice Management Software?

When choosing Invoice Management Software, there are a few key factors that businesses should consider. These include

- Ease of use: The invoice management software should be easy to use, intuitive, and mostly, a no-code platform so everyone can use it efficiently.

- Features: Check your requirements and map your requirements with the features of the platform. The invoice management platform should allow invoice automation, invoice matching, delivery, payment tracking, and reporting.

- Integration Capabilities: The software should be able to integrate with the business’s existing systems, such as accounting software, to avoid the need for manual data entry. Look for solutions with a wide range of pre-built integrations to minimize implementation challenges.

- Customization and Flexibility: Look for solutions that allow you to customize workflows to match your existing processes. Ensure the software can adapt to your specific industry needs and company structure.

- Cost: The cost of the software should be reasonable, and the business should consider the long-term benefits of using the software versus the upfront cost.

- Security: The software should provide robust security measures to protect sensitive financial data and prevent unauthorized access.

- Customer support: The software provider should offer timely and helpful customer support to assist users with any questions or issues that may arise.

- Automation capabilities: To use automation to it’s full potential, your invoice management software should have advanced workflow management capabilities which can automate manual processes.

Final thoughts

The right invoice management software can slash processing times, reduce errors, improve cash flow visibility, and free up resources for strategic tasks. When choosing, consider factors like integration capabilities, ease of use, customization options, and scalability.

Remember, the ideal solution should meet your current needs and grow with your business. Take advantage of free trials to test-drive options before committing.

Investing in the right invoice management software is an investment in your company’s efficiency and financial health. By optimizing your invoice processes, you’re positioning your business for success in our increasingly digital world.

Automate every aspect of invoice management with automated workflows, OCR, and a global payment platform at fraction of the cost!

FAQs

Who uses Invoice Management Software?

Invoice Management Software is used by businesses of all sizes across various industries. This includes retail stores, service-based businesses (like law and accounting firms), freelancers, e-commerce companies, and more. Essentially, any business that regularly invoices clients or customers can benefit from streamlining their invoicing process with this software.

What are the different kinds of Invoice Management Software?

Invoice Management Software comes in three main types:

- Cloud-based: Accessed online, ideal for remote work.

- On-premises: Installed locally, suitable for businesses prioritizing on-site data control.

- Customizable: Tailored to specific business needs, allowing feature additions or removals.

What software should I use for invoicing?

The best invoicing software depends on your specific business needs. But, Nanonets is a great option. It offers advanced features like OCR software, workflow automation, document management, and seamless integrations. With a free trial, excellent customer support and transparent pricing options, Nanonets is the best bet for organizations looking to optimize their invoice processes.

Why use invoice management software?

Invoice management software offers multiple benefits:

- Improves cash flow by automating invoicing and payment tracking.

- Reduces lost or overdue invoices through better tracking and reminders.

- Enhances financial visibility, allowing for better decision-making.

- Boosts productivity by automating manual processes.

- Increases accuracy and ensures compliance with regulations.

Which is the best billing software?

There’s no one-size-fits-all “best” billing software. However, standout options include:

- Nanonets for its all-in-one AP automation and AI capabilities

- QuickBooks Online for small businesses needing integrated accounting

- SAP Concur for large enterprises with complex needs

- Tipalti for businesses with global payment requirements

- AvidXchange for middle-market companies seeking comprehensive AP automation

How do you manage invoices?

Effective invoice management involves:

- Capturing invoice data accurately (often using OCR technology)

- Validating invoice information

- Routing invoices for approval

- Processing payments

- Reconciling invoices with payments

- Storing invoice data securely for future reference

Modern invoice management software automates many of these steps, improving efficiency and accuracy.

What is the invoice process?

The invoice process typically includes:

- Receiving the invoice (electronically or physically)

- Extracting and validating invoice data

- Matching the invoice to purchase orders or contracts

- Routing the invoice for approval

- Processing payment

- Recording the transaction in the accounting system

- Storing the invoice for record-keeping

What is invoice flow management?

Invoice flow management refers to the systematic handling of invoices from receipt to payment. It involves:

- Establishing clear processes for invoice handling

- Automating repetitive tasks

- Setting up approval workflows

- Tracking invoice status throughout the process

- Ensuring timely payments

- Maintaining audit trails

- Analyzing invoice data for business insights

Effective invoice flow management aims to streamline the entire invoicing process, reduce errors, improve cash flow, and provide better financial visibility.