Seven Best Practices for Effective Account Reconciliations

From Mesopotamia’s rudimentary ledgers tracking livestock and crops to the second-century BCE Indian treatise “Arthashastra“, accounting has been a cornerstone of economic management in any civilized society. Today, amidst burgeoning global commerce and rapidly expanding business operations, the importance of accounting operations endures. At the core of accounts management lies account reconciliation, the process of comparing various financial documents to ensure accuracy and accountability.

In this article, we shall explore the fundamentals of accounts reconciliation, discussing its importance, processes, and best practices.

What is Account Reconciliation

Account reconciliation is an important process in financial management that ensures accuracy and consistency in financial operations. It provides critical insights into a company’s financial health and performance. There are various types of account reconciliation, each offering distinct benefits: Bank Account Reconciliation aligns cash balances, Accounts Payable Reconciliation matches vendor amounts, Accounts Receivable Reconciliation confirms customer payments, Inventory Reconciliation validates inventory valuation, Payroll Reconciliation ensures accurate employee salary recording, Credit Card Reconciliation verifies transactions and Fixed Asset Reconciliation tracks asset movements and values, aiding in financial planning and management.

Need for Account Reconciliation

Account Reconciliation ensures the accuracy and integrity of financial records by identifying discrepancies and errors, thus fostering trust among stakeholders and facilitating informed decision-making. It aids in the detection and prevention of fraud, safeguarding against financial losses and reputational damage. Effective Account Reconciliation promotes compliance with regulatory requirements and accounting standards, mitigating the risk of penalties and legal consequences. By providing a clear and transparent picture of an organization’s financial health, account reconciliation empowers businesses to optimize resource allocation, streamline operations, and drive sustainable growth.

How to conduct Account Reconciliation

The process of Account Reconciliation involves several key steps to ensure accuracy and completeness:

- Gather Documents: Collect financial records like bank statements, invoices, and ledger entries.

- Identify Accounts: Determine accounts needing reconciliation, including bank, payables, receivables, inventory, payroll, and assets.

- Compare Records: Match internal records with external sources like bank statements and invoices.

- Investigate Discrepancies: Analyze differences, trace transactions and rectify errors.

- Make Adjustments: Record missing transactions and correct errors for accurate balances.

- Document Process: Maintain detailed records of steps, findings, and adjustments.

- Review and Approve: Validate reconciled accounts for accuracy, seeking approval from stakeholders.

- Implement Controls: Introduce measures to prevent future discrepancies and ensure accuracy.

Common Challenges and Discrepancies in the Account Reconciliation Process

The Account Reconciliation process comes with its own set of challenges and potential discrepancies. Here are some common ones:

- Data Entry Errors: Human errors during data entry can lead to discrepancies between internal records and external sources. Transposing numbers, omitting transactions, or recording incorrect amounts can distort the accuracy of reconciled accounts.

- Timing Differences: Differences in timing between when transactions are recorded internally and when they appear in external statements, such as bank statements, can create challenges in reconciliation. For example, checks may be issued but not yet cashed, leading to timing discrepancies.

- Bank Errors: Banks can make errors in processing transactions, such as posting incorrect amounts or duplicating entries. Identifying and rectifying these errors can be time-consuming and require coordination with the bank.

- Unrecorded Transactions: Failure to record all transactions, such as outstanding checks or pending deposits, can lead to discrepancies in reconciled accounts. It’s essential to ensure that all transactions are accurately recorded and accounted for.

- Fraudulent Activities: Fraudulent activities, such as unauthorized transactions or embezzlement, can go undetected during the reconciliation process, leading to significant financial losses for the company.

- Complex Transactions: Complex transactions, such as foreign currency exchanges or mergers and acquisitions, can pose challenges in reconciliation due to their intricate nature and multiple accounting implications.

- System Errors: Errors or glitches in accounting software or systems can result in discrepancies in reconciled accounts. Regular maintenance and updates are necessary to mitigate the risk of system-related errors.

- Lack of Documentation: Insufficient documentation or missing supporting documents for transactions can hinder the reconciliation process, making it difficult to verify the accuracy of recorded transactions.

- Incomplete Records: Incomplete or outdated records can complicate the reconciliation process, as it may be challenging to trace transactions or verify balances without complete information.

- Staff Turnover: High staff turnover or inadequate training of accounting personnel can impact the quality and consistency of the reconciliation process, increasing the likelihood of errors and discrepancies.

Best Practices in Account Reconciliation

Here are some best practices in account reconciliation that help in maintaining accurate financial records and ensuring the integrity of the financial reporting process:

- Regular Reconciliation Schedule: Establish a regular schedule for conducting account reconciliations, such as monthly or quarterly. Consistent reconciliation helps identify discrepancies promptly and prevents the accumulation of errors over time. For example, a company may reconcile its bank accounts at the end of each month to ensure accuracy in cash balances.

- Segregation of Duties: Implement segregation of duties to prevent errors and fraud. Assign different individuals to perform reconciliations, approve transactions, and record accounting entries. This separation of duties helps ensure checks and balances in the reconciliation process. For instance, one person may reconcile bank statements while another reviews and approves the reconciled balances.

- Documentation and Record-Keeping: Maintain thorough documentation of the reconciliation process, including supporting documents, audit trails, and explanations for any adjustments made. Proper documentation provides a clear audit trail and facilitates transparency and accountability. For example, keep copies of bank statements, invoices, and receipts as evidence of reconciled transactions.

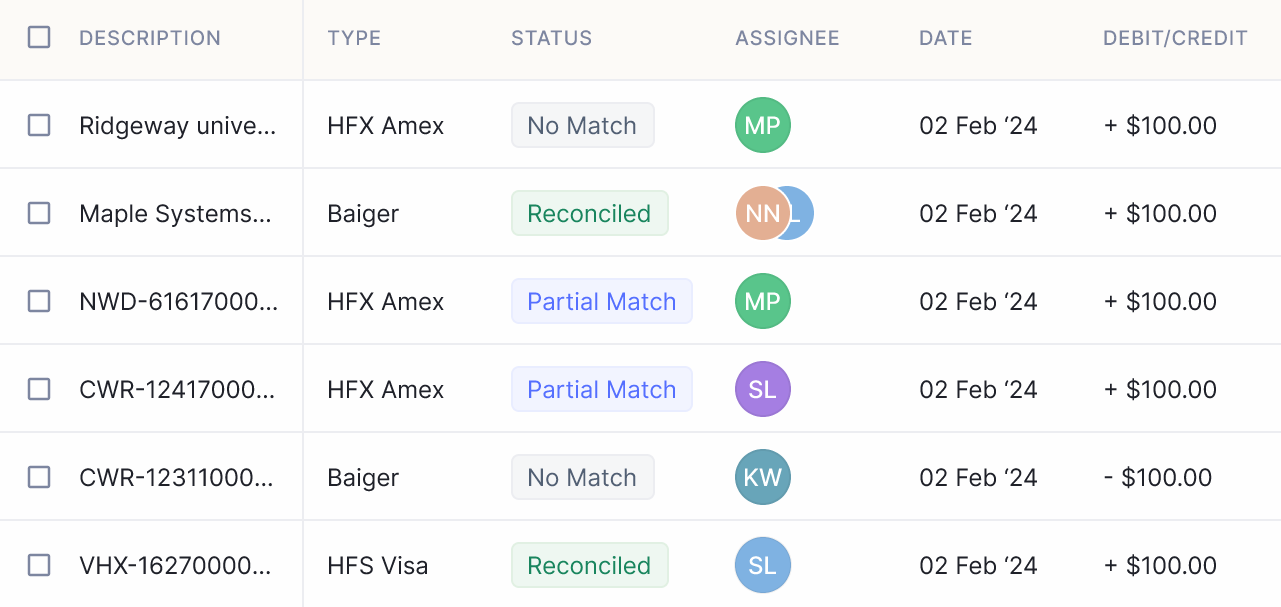

- Use of Reconciliation Tools: Utilize accounting software and reconciliation tools to streamline the reconciliation process and minimize manual errors. Automated reconciliation software can match transactions, identify discrepancies, and generate reports efficiently. For instance, reconciliation software can automatically compare bank transactions with accounting records and highlight any discrepancies for further investigation.

- Review and Approval Procedures: Establish review and approval procedures for reconciled accounts to ensure accuracy and completeness. Assign responsibility to designated personnel for reviewing reconciled balances and approving adjustments before finalizing the reconciliation. For example, a financial manager may review and approve bank reconciliations before they are submitted for audit.

- Continuous Monitoring and Analysis: Continuously monitor account balances and trends to identify anomalies or irregularities that may require further investigation. Regular analysis of reconciled accounts helps detect errors, fraud, or inefficiencies early on, allowing for timely corrective action. For instance, perform trend analysis on accounts receivable balances to identify overdue payments or potential bad debts.

- Training and Education: Provide ongoing training and education to accounting staff on reconciliation best practices, accounting standards, and regulatory requirements. Ensure that staff are equipped with the necessary skills and knowledge to perform accurate and effective reconciliations. For example, conduct regular training sessions on reconciliation procedures, software usage, and fraud detection techniques.

By implementing these best practices, businesses can enhance the accuracy, reliability, and efficiency of the account reconciliation process, ultimately improving financial reporting and decision-making capabilities.

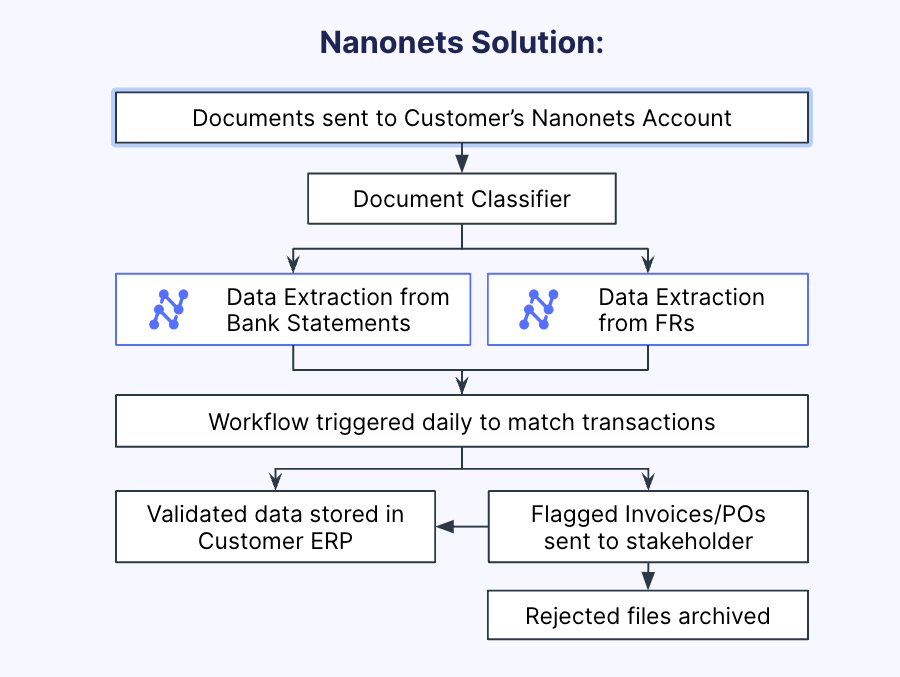

Automate the Reconciliation Process with Nanonets

When it comes to automating reconciliation tasks, Nanonets stands out as one of the premier software solutions on the market. Nanonets offers several features that make it well-suited for automating account reconciliation processes:

- Customizable Models: Nanonets provides tools to create custom OCRmodels tailored to specific reconciliation needs. This customization allows organizations to train models based on their unique data sets and reconciliation requirements, ensuring optimal performance and accuracy.

- Data Extraction Capabilities: Nanonets includes features for extracting data from various sources, including scanned documents, PDFs, images, and structured data formats like CSV or Excel. This flexibility in data extraction enables organizations to reconcile transactions from diverse sources, such as invoices, receipts, bank statements, and purchase orders.

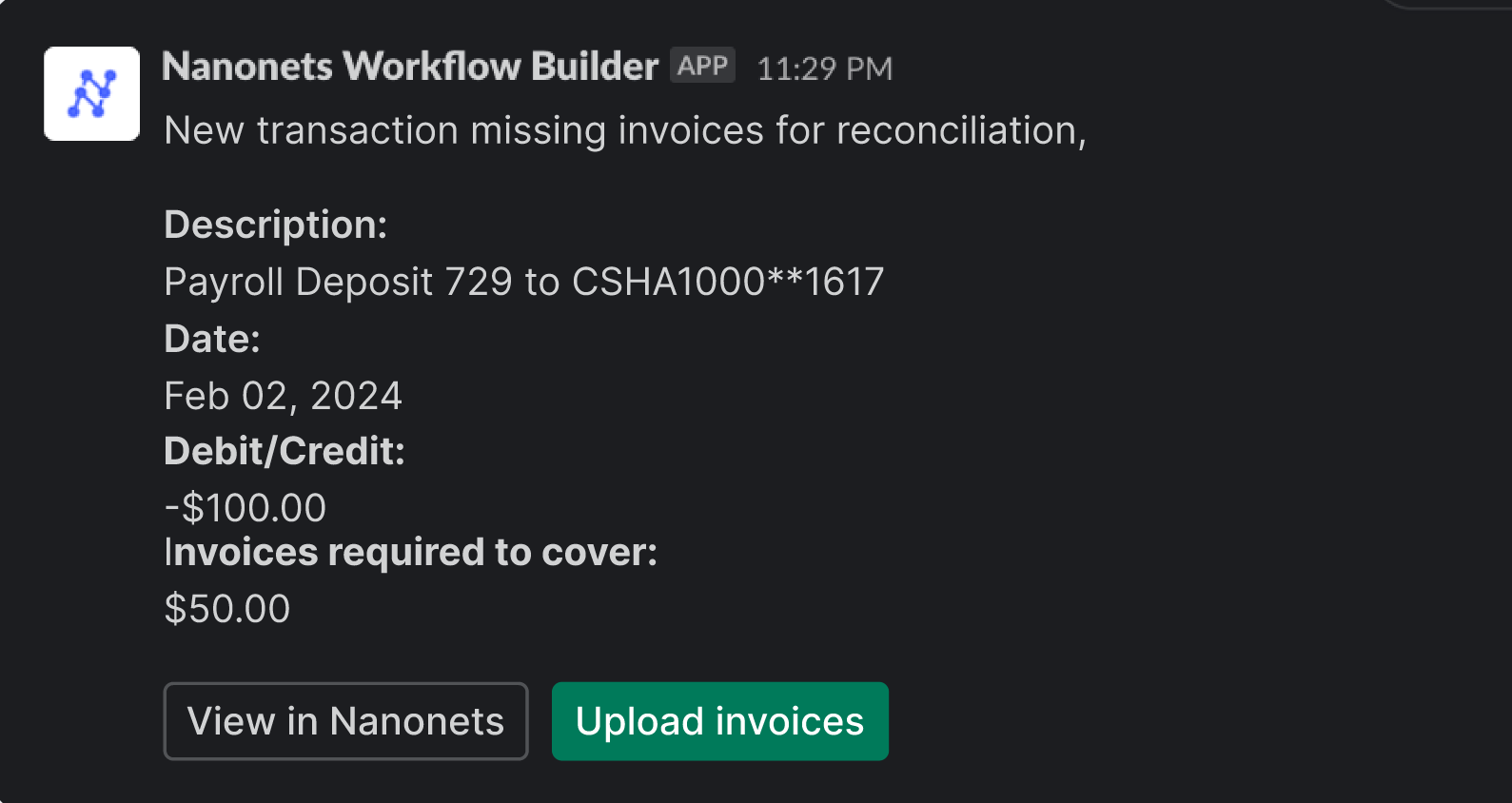

- API Integration and Workflow Automation: Nanonets offers APIs and integration capabilities that allow seamless integration with existing systems and workflows. Organizations can incorporate Nanonets’ reconciliation functionality into their existing accounting or ERP systems, streamlining the reconciliation process and eliminating manual data entry tasks.

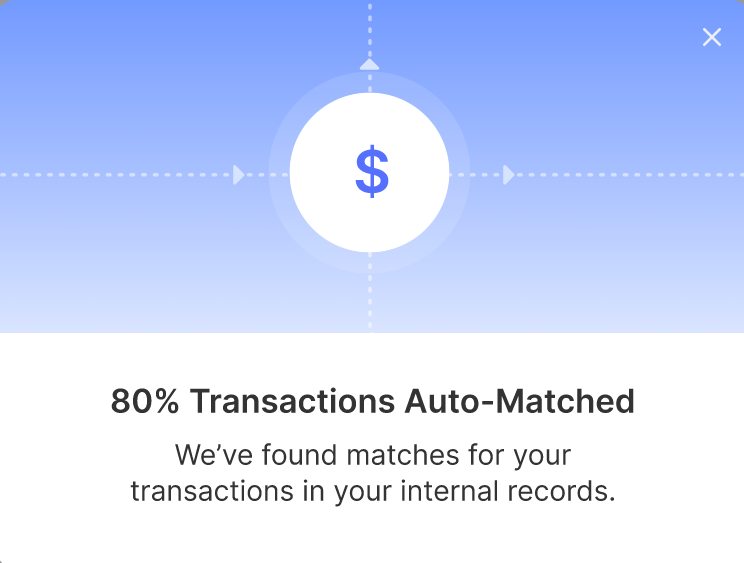

- Real-time Reconciliation: With Nanonets, organizations can perform real-time reconciliation, allowing for immediate detection and resolution of discrepancies as transactions occur. This real-time capability enhances financial visibility and control, enabling organizations to make informed decisions based on up-to-date financial data.

- Accuracy and Confidence Scoring: Nanonets provides confidence scoring mechanisms that assess the accuracy of reconciliation outcomes and provide insights into the reliability of match results. This feature enables users to prioritize and review reconciliation results based on confidence levels, ensuring high-quality outcomes and minimizing the risk of errors.

Take Away

Effective account reconciliation is vital for financial accuracy and integrity. Implementing best practices like regular reviews and segregation of duties mitigates errors and ensures compliance. Yet, manual processes are time-consuming and error-prone. Software solutions like Nanonets use advanced algorithms to automate the account reconciliation process, thereby empowering finance teams to focus on strategic initiatives, enhancing efficiency and transparency.