The Top Credit Card Reconciliation Softwares in 2024

Credit card reconciliation is a crucial aspect of financial management for businesses of all sizes. It is the process of comparing and matching credit card transactions with corresponding spends and financial records to ensure accuracy and transparency in financial reporting.

As businesses increasingly rely on credit cards for various expenses, the need for efficient reconciliation processes becomes more important. In this blog, we dive into the world of credit card reconciliation, the top softwares to solve this, key features to look for and challenges to overcome, and how solutions like Nanonets can help businesses.

What is Credit Card Reconciliation?

Credit card reconciliation is the process of comparing credit card statements with corresponding records to ensure accuracy and consistency in financial reporting. It involves matching individual credit card transactions, such as purchases, payments, and fees, with entries in the company’s accounting records. The goal of credit card reconciliation is to identify discrepancies, errors, or fraudulent activities, ensuring that all transactions are properly accounted for and recorded.

Typically, credit card reconciliation begins with the collection of credit card statements from various sources, such as banks or financial institutions. These statements contain details of transactions made using the company’s credit cards within a specific period, including the date, amount, merchant name, and transaction description.

Once the credit card statements are obtained, the reconciliation process involves comparing each transaction listed on the statements with corresponding entries in the company’s accounting records. This may include invoices, receipts, purchase orders, or other documentation related to the transactions. The reconciliation software or tools automate this matching process, significantly reducing the time and effort required for manual reconciliation.

During the reconciliation process, discrepancies or inconsistencies between the credit card statements and accounting records are identified and investigated. This may involve verifying the accuracy of transaction details, reconciling differences in amounts, or identifying unauthorised or fraudulent transactions. Any discrepancies found are then addressed and resolved to ensure the accuracy of the company’s financial records.

Credit card reconciliation is essential for businesses to maintain financial integrity, compliance with regulations, and effective management of expenses. It provides insights into spending patterns, helps identify areas of inefficiency or fraud, and ensures that all transactions are properly recorded in the company’s accounting system. By automating the reconciliation process with dedicated software solutions, businesses can streamline their financial operations, improve accuracy, and reduce the risk of errors or fraud.

What is Credit Card Reconciliation Software?

Credit card reconciliation software is a specialised tool to streamline and automate the credit card reconciliation process for businesses. It simplifies the task of matching credit card transactions with corresponding entries in the company’s accounting records, helping to ensure accuracy, efficiency, and compliance.

Credit card reconciliation software typically offers a range of features and functionalities to facilitate the reconciliation process. These include:

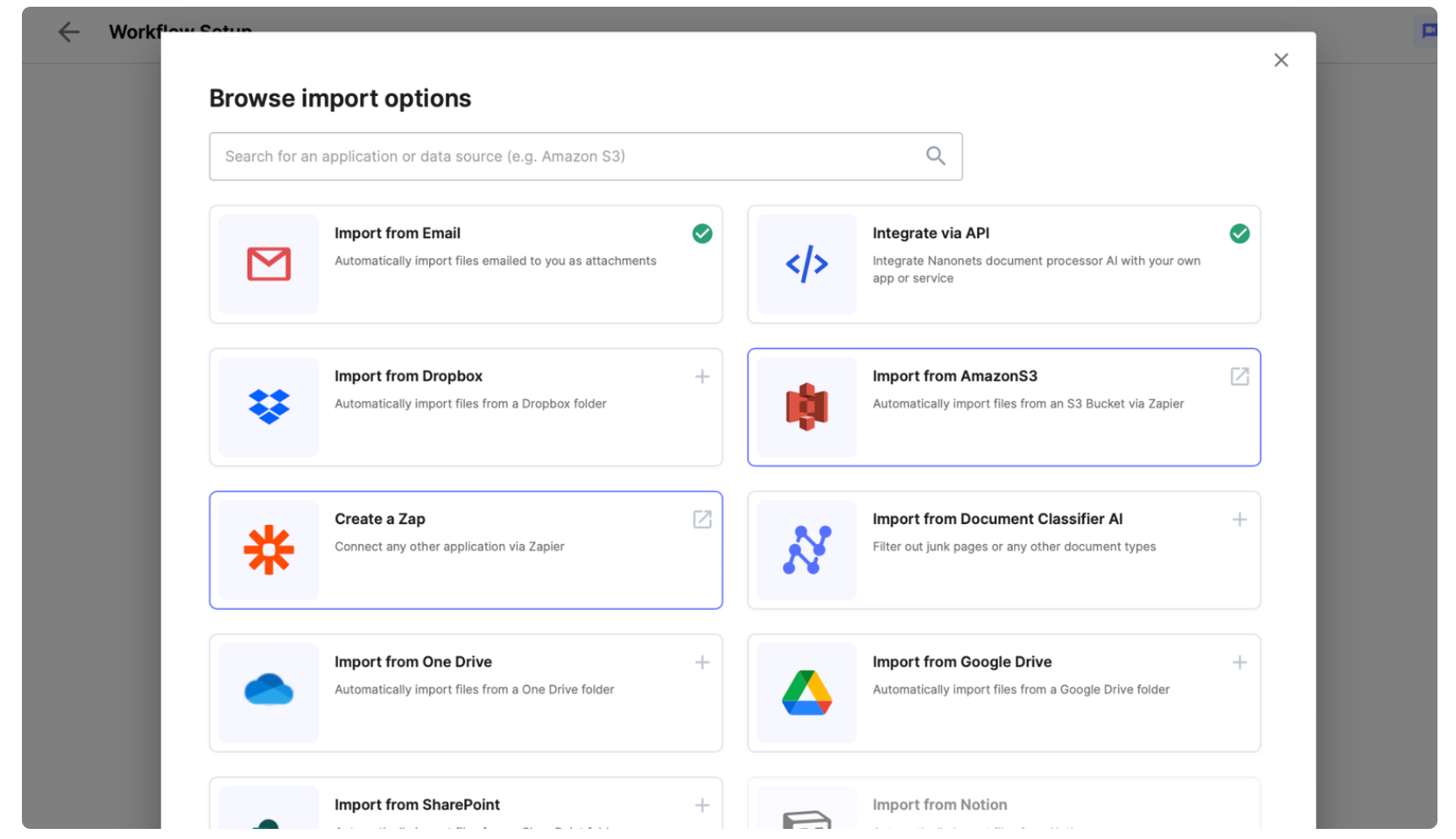

- Automated Data Import: The software can automatically import credit card statements and transaction data from various sources, such as banks or financial institutions, eliminating the need for manual data entry.

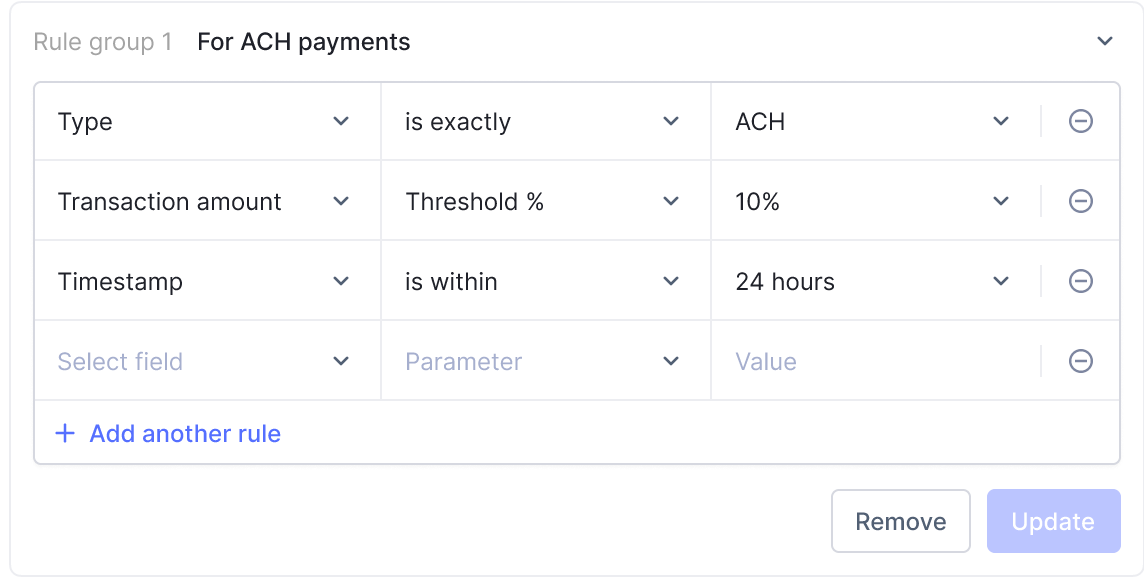

- Transaction Matching: The software matches individual credit card transactions with corresponding entries in the company’s accounting system, such as invoices, receipts, or purchase orders. It uses algorithms and rules to identify matches based on transaction details, such as date, amount, merchant name, and transaction description.

- Error Detection and Resolution: The software detects discrepancies or inconsistencies between credit card statements and accounting records, such as missing transactions, duplicate entries, or incorrect amounts. It provides tools to investigate and resolve these discrepancies promptly.

- Reporting and Analytics: Credit card reconciliation software generates reports and analytics to provide insights into spending patterns, trends, and anomalies. It helps businesses track expenses, identify areas of inefficiency, and make informed financial decisions.

- Integration with Accounting Systems: The software integrates seamlessly with the company’s accounting software or ERP system, ensuring that reconciled transactions are accurately recorded and reflected in financial reports.

- Security and Compliance: Credit card reconciliation software prioritises data security and compliance with industry regulations, such as PCI DSS (Payment Card Industry Data Security Standard). It employs encryption, access controls, and audit trails to protect sensitive financial information.

Overall, credit card reconciliation software streamlines the reconciliation process, reduces manual effort, improves accuracy, and enhances visibility and control over credit card transactions. It is a valuable tool for businesses of all sizes, helping them effectively manage their finances, mitigate risks, and ensure financial integrity.

Benefits of Using Credit Card Reconciliation Software

Credit card reconciliation software helps businesses streamline their financial processes, improve accuracy, and enhance efficiency. Some specific, key benefits of using credit card reconciliation software include:

- Improved Accuracy: By automating the reconciliation process and using advanced matching algorithms, credit card reconciliation software minimizes the risk of errors and discrepancies. It ensures that credit card transactions are accurately recorded and reconciled with corresponding entries in the company’s accounting records.

- Time Savings: Credit card reconciliation software eliminates the need for manual data entry and tedious reconciliation tasks, saving time for finance teams. It automates repetitive tasks, such as importing credit card statements, matching transactions, and generating reports, allowing employees to focus on more strategic activities.

- Enhanced Efficiency: With credit card reconciliation software, businesses can complete the reconciliation process more quickly and efficiently. The software streamlines workflows, standardised processes, and provides tools for error detection and resolution, enabling finance teams to work more effectively and productively.

- Greater Visibility and Control: Credit card reconciliation software provides real-time visibility into credit card transactions, expenses, and financial performance. It allows businesses to track spending patterns, monitor budget adherence, and identify potential issues or discrepancies promptly. With better visibility and control, businesses can make more informed financial decisions and mitigate risks effectively.

- Compliance and Audit Readiness: Credit card reconciliation software helps businesses maintain compliance with regulatory requirements and industry standards, such as PCI DSS. It ensures that credit card transactions are accurately recorded, properly authorised, and securely processed, reducing the risk of non-compliance and audit findings.

- Cost Savings: By reducing manual effort, minimising errors, and improving efficiency, credit card reconciliation software can lead to cost savings for businesses. It lowers labour costs associated with manual reconciliation tasks, reduces the risk of financial losses due to errors or fraud, and optimises resource utilisation within the finance department.

Overall, credit card reconciliation software offers significant benefits for businesses, helping them optimise their financial processes, mitigate risks, and achieve greater efficiency and accuracy in managing credit card transactions.

Common Challenges with Credit Card Reconciliation

Navigating credit card reconciliation comes with its share of challenges, often presenting hurdles that can impede financial accuracy and efficiency. Below are some of the common types of challenges encountered in credit card reconciliation:

Difficulty in Matching Transactions with Corresponding Receipts:

One of the primary challenges is accurately matching credit card transactions with their corresponding receipts or invoices. This task can become particularly cumbersome in cases where employees fail to provide or retain receipts, leading to discrepancies and incomplete records.

Manual Entry Errors Leading to Discrepancies:

Manual data entry is susceptible to human error, which can result in discrepancies between recorded transactions and actual expenses. Mistakes such as typos, incorrect amounts, or misclassifications can compromise the accuracy of reconciliation efforts and potentially lead to financial misstatements.

Time-Consuming Reconciliation Process:

Credit card reconciliation often involves a labor-intensive process of manually reviewing and reconciling transactions, which can be time-consuming, especially for businesses with high transaction volumes. The manual effort required to sift through statements, match transactions, and identify discrepancies can significantly prolong the reconciliation timeline.

Lack of Visibility into Credit Card Spending:

Without comprehensive visibility into credit card spending across departments or individuals, businesses may struggle to monitor expenses effectively. This lack of transparency can make it challenging to identify unauthorized purchases, track budget adherence, or analyze spending patterns for strategic decision-making.

Addressing these challenges requires leveraging the right credit card reconciliation tools as well as adopting efficient processes to streamline reconciliation workflows, minimize errors, and enhance financial visibility and control. In the next section, we’ll explore some of the top credit card reconciliation softwares that make the whole process easier.

Top Credit Card Reconciliation Softwares

The following credit card reconciliation solutions are highly-rated among users and are products made by reputed software companies. They offer a range of features and functionalities to meet the diverse needs of businesses.

Evaluating each option based on its key features, pros, cons, pricing, and user reviews can help you make an informed decision according to your organisation’s credit card reconciliation needs.

- Expensify

- Key Features: Payments superapp with automated expense reporting, receipt tracking, real-time analytics, and more

- Pros: User-friendly interface, robust mobile app, seamless integration with accounting software.

- Cons: Limited customization options, occasional syncing issues with bank accounts.

- Pricing: From solo startups to big businesses, there are subscription-based pricing models ranging from $5 per user per month to $9 per user per month.

- User Reviews: Rated 4.5/5 based on 5,000+ reviews on G2, appreciated for its simplicity and efficiency.

- Bill.com

- Key Features: Leading financial operations app for small to medium businesses, offering automated accounts payable, invoice processing, payment scheduling, and more

- Pros: Streamlined approval workflows, secure payment processing, comprehensive audit trail

- Cons: Steeper learning curve for new users, occasional delays in payment processing

- Pricing: Tiered pricing plans based on business size and needs, starting from $39 per user per month.

- User Reviews: Rated 4.4/5 based on 1,000+ reviews on Capterra, commended for its reliability and ease of use.

- QuickBooks Online

- Key Features: Online accounting, expense tracking, bank reconciliation.

- Pros: Intuitive interface, customizable reports, seamless integration with bank accounts.

- Cons: Limited scalability for larger businesses, occasional software updates affecting functionality.

- Pricing: Subscription-based pricing model, starting from $25 per month.

- G2/Capterra Reviews: Rated 4.5/5 based on X reviews on G2, praised for its accessibility and affordability.

- Xero

- Key Features: Cloud-based accounting, expense management, real-time financial reporting.

- Pros: User-friendly interface, extensive third-party integrations, multi-currency support.

- Cons: Limited customer support options, occasional downtime during system maintenance.

- Pricing: Tiered pricing plans based on business size and needs, starting from $11 per month.

- G2/Capterra Reviews: Rated 4.8/5 based on X reviews on G2, lauded for its flexibility and scalability.

- Sage Intacct

- Key Features: Cloud-based financial management, automated billing, revenue recognition.

- Pros: Advanced reporting capabilities, customizable dashboards, robust compliance features.

- Cons: Higher pricing tier, limited support for certain industries, complex setup process.

- Pricing: Customized pricing based on business requirements, with a free trial option available.

- G2/Capterra Reviews: Rated 4.7/5 based on X reviews on G2, appreciated for its comprehensive feature set and reliability.

Nanonets for Credit Card Reconciliation

Nanonets offers a comprehensive and efficient solution for credit card reconciliation, leveraging advanced technologies such as artificial intelligence (AI) and machine learning (ML) to automate and streamline the reconciliation process. Here are some ways it stands out as an excellent choice for credit card reconciliation:

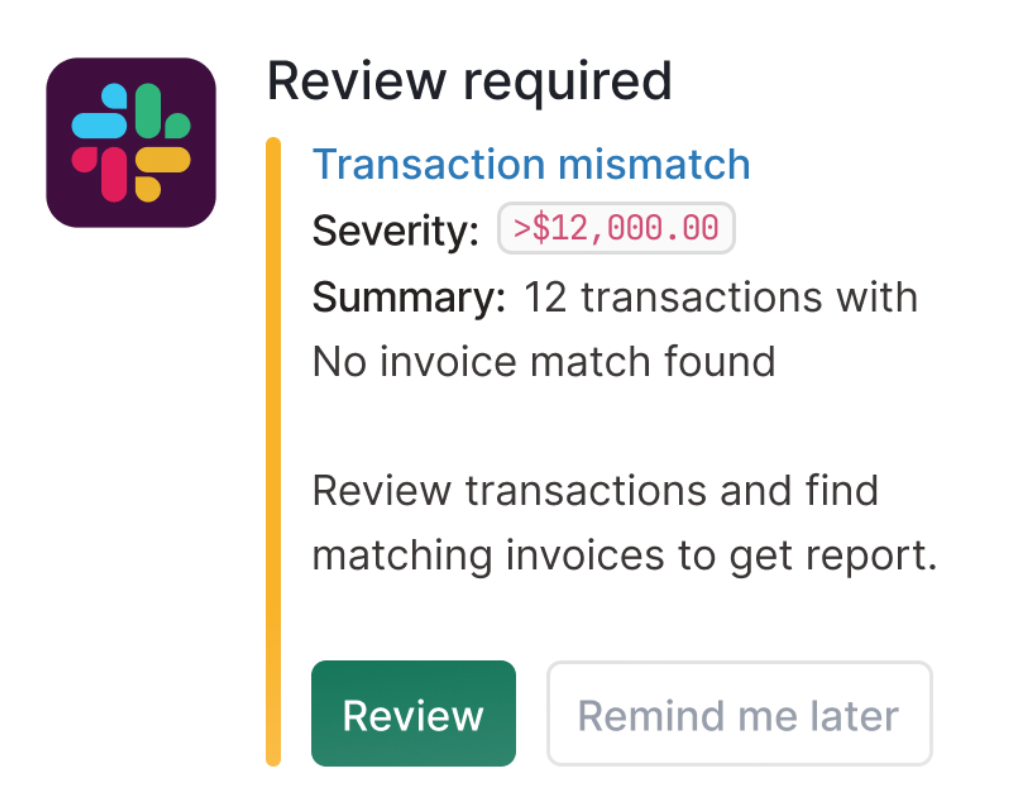

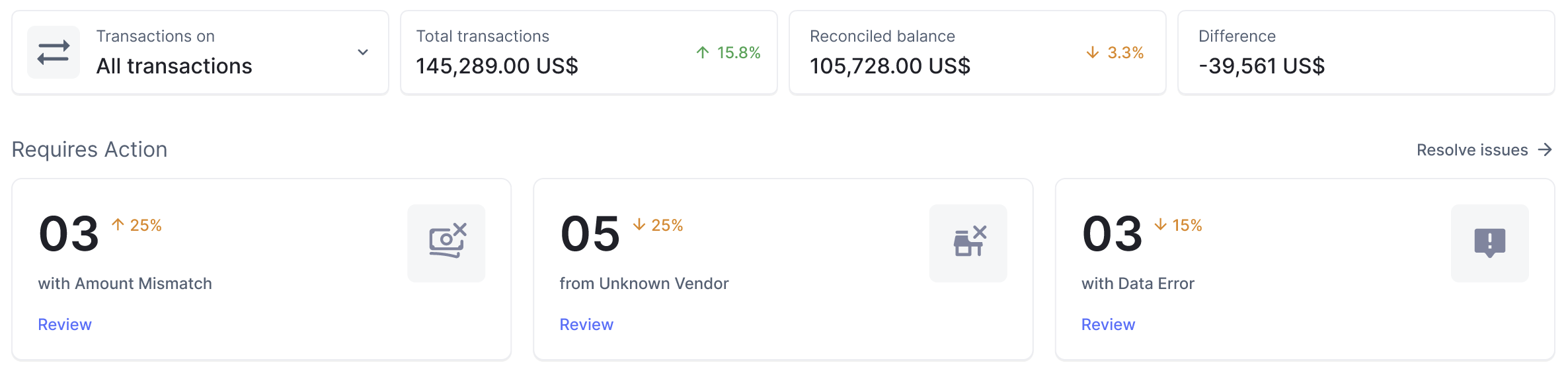

- Advanced Automation: Nanonets’ AI-powered algorithms can automatically match credit card transactions with corresponding entries in your accounting records, significantly reducing manual effort and human error.

- Accuracy and Precision: With Nanonets, you can expect precise reconciliation results, as the software is capable of identifying and flagging discrepancies or anomalies in credit card transactions promptly.

- Customizable Workflows: Nanonets allows you to tailor the reconciliation process to fit your organisation’s specific needs and requirements, ensuring that it aligns seamlessly with your existing workflows and processes.

- Integration Capabilities: Nanonets can integrate seamlessly with your existing accounting software, payment gateways, and bank accounts, providing a unified platform for managing all aspects of credit card reconciliation.

- Real-time Insights: Nanonets provides real-time visibility into your credit card transactions, allowing you to monitor and track your financial data with ease and confidence.

- Cost-effectiveness: Nanonets offers competitive pricing plans tailored to suit businesses of all sizes, making it a cost-effective solution for credit card reconciliation needs.

By choosing Nanonets for your credit card reconciliation software, you can streamline your reconciliation process, improve accuracy and efficiency, and gain valuable insights into your financial data, ultimately helping your organisation achieve greater financial success and stability.

Conclusion

Credit card reconciliation software plays a crucial role in ensuring financial accuracy and transparency for businesses of all sizes. By automating the reconciliation process, these software solutions help streamline operations, reduce errors, and improve overall efficiency.

In this blog, we explored the importance of credit card reconciliation software, its key features, and some of the top solutions available in the market. Whether you’re a small startup or a large enterprise, investing in the right credit card reconciliation software can yield significant benefits and help drive success in today’s competitive business landscape.