Sometimes, basic business processes can be way more time-consuming than business leaders realize. Invoicing, for instance, is something that every single accounting team has to learn how to manage.

At its core, invoicing seems simple: a vendor provides goods or services, details the items provided, and sends a bill to the customer (AKA an invoice). The customer then invoice receives the invoice, verifies its accuracy, and submits payment to the vendor.

Simple, right? It may seem that way, but in reality, 66% of businesses say that they spend more than five days per month processing invoices. With only 20-25 business days per month, the impact of five whole days being consumed by sending, receiving, and processing invoice payments is a major lift for an organization’s accounts receivable team and its accounts payable team.

Today, one of the best ways to address process inefficiencies and enhance organizational efficiency is to invest in digital SaaS solutions that streamline said processes. Xero, one of the premier SaaS accounting tools for small and mid-size businesses, helps address invoicing-related inefficiencies and other challenges in the accounting cycle.

In isolation, Xero invoice software is a robust solution, but when paired with other AP automation tools, its effectiveness increases exponentially. Let’s take a look at what Xero invoice solutions can offer to businesses, then look at what Xero can do when paired with other SaaS offerings.

Xero Invoicing Software for Accounts Receivable

All too familiar with cash flow challenges and chasing down overdue invoice payments, the accounts receivable team is responsible for collecting all the money a business makes. Whether an organization is B2B or B2C, the AR team is critical in ensuring that cash is coming into the business at a rate that supports business expenses and growth initiatives.

How to do AR in Xero

Instead of manually creating invoices for each customer, sending individual emails to alert users of upcoming payments, and building manual cash flow reports, AR teams can integrate Xero into the AR ecosystem to access a number of helpful features and automated invoicing capabilities.

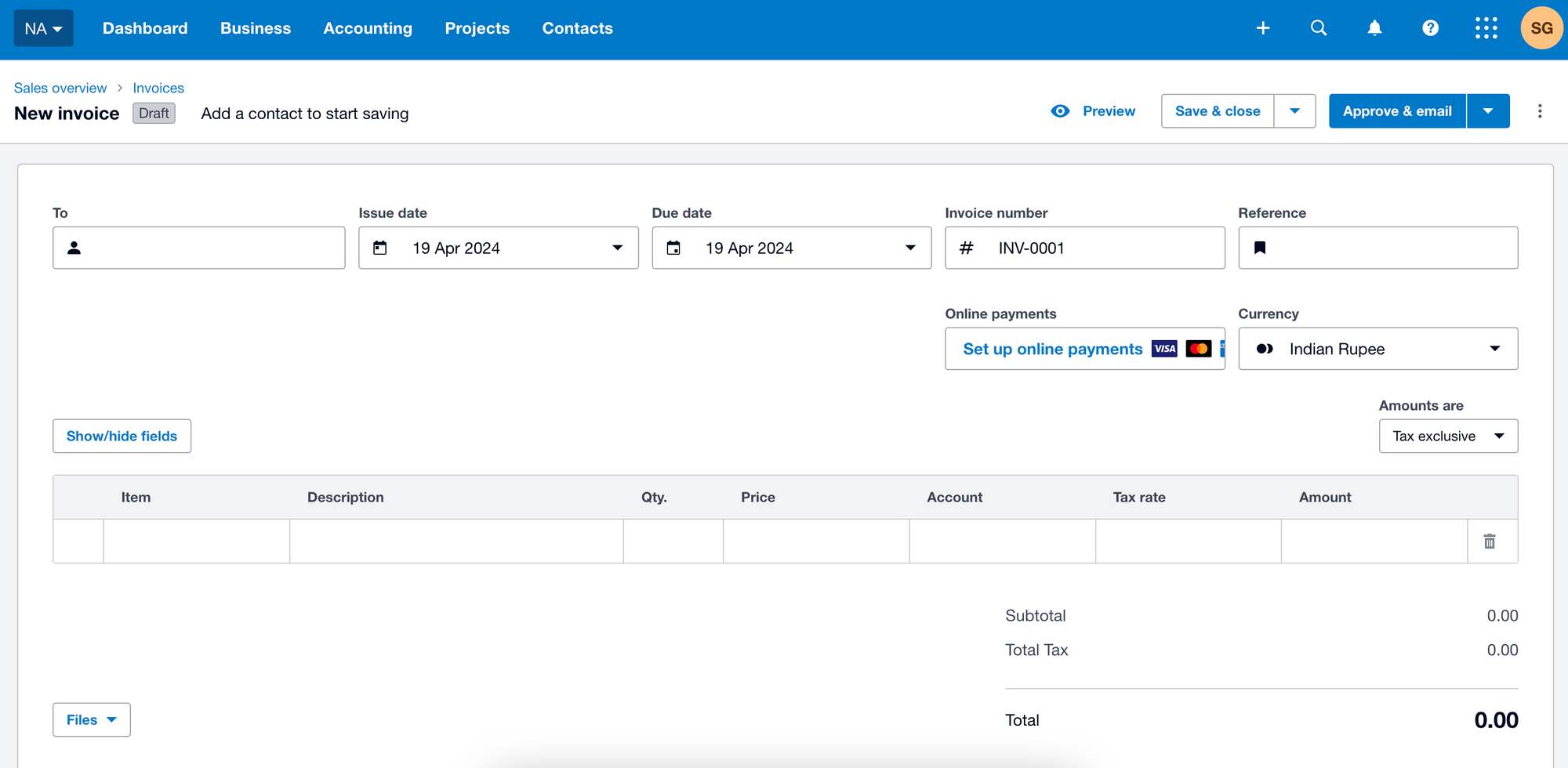

With Xero, invoice creation and every task following are much easier. You’ll be asked to choose between “classic invoicing” and “new invoicing” within Xero; if efficiency is your goal, choose “new invoicing” to reduce the workload and manual data lift. Here’s how invoice creation looks when using Xero “new invoicing”:

- Make sure the customer contact information is added to Xero first. With new invoicing, you can auto-populate some fields with these details.

- Go to the “Invoice” module in the Xero application.

- Start typing the customer name in the “To” field, and the customer details should populate within the invoice.

- Fill in all required fields such as “Item,” “Quantity,” and “Price.”

- Drag-and-drop line items to move them around in a certain order.

- When the invoice is filled out, choose “Save and Add Another” or “Submit for Approval.”

Not only does Xero invoice software allow AR experts to send automated payment reminders and create customized invoices with ease, but it offers a whole host of AR-targeted features, such as:

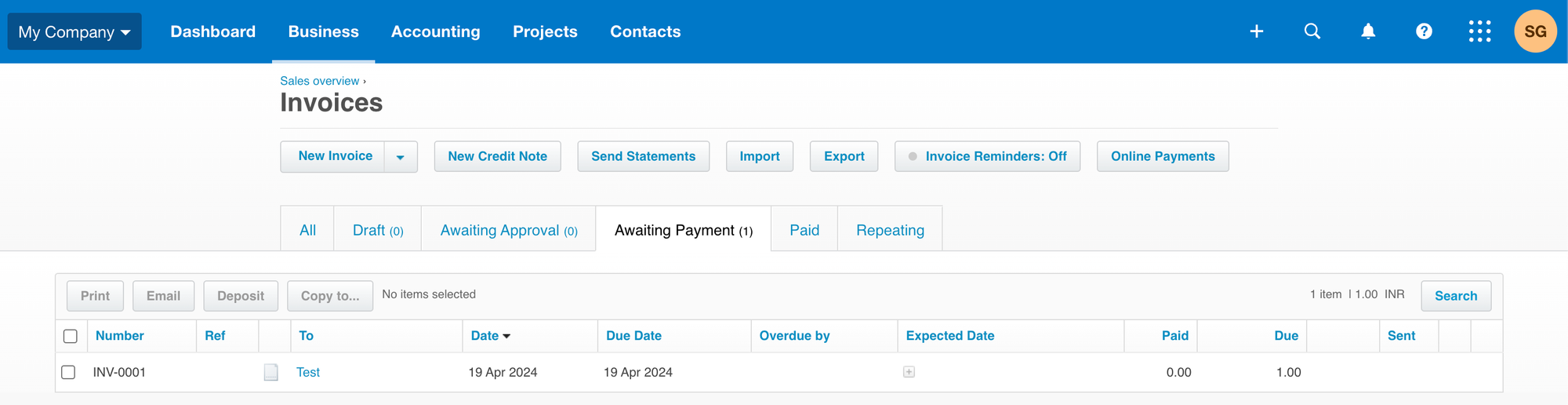

Invoice Status Tracking

Distributing invoices the first time around is hard enough; Xero not only transforms the initial invoice creation process to just a few clicks, but it also provides invoice tracking and analytics in real-time. Is there a customer with outstanding payments or continued payment issues? Xero can help notify the AR team before your company loses out on hard-earned cash.

Online Payment Processing

Customers are over sending checks – they want to pay online! Online payment processing is within reach with the right third-party plugins available through Xero. Customers will love how easy it is, and the AR team will love that it’s largely a no-touch process from their side.

Xero Invoice Templates

Official invoices with a uniform style, embedded logo, and low error rate can help businesses build a brand of reliability and trust, and with Xero invoice templates, pristine invoices are unavoidable.

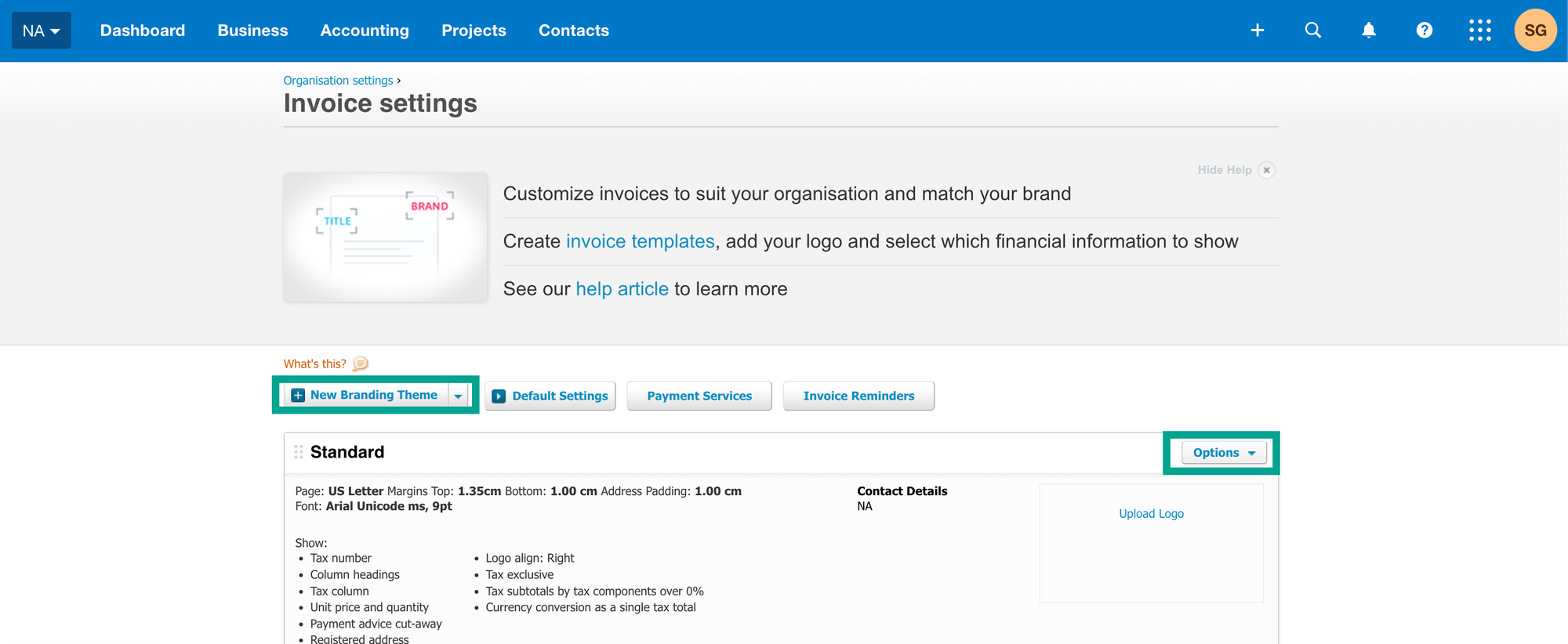

To create a Xero invoice template, follow the below:

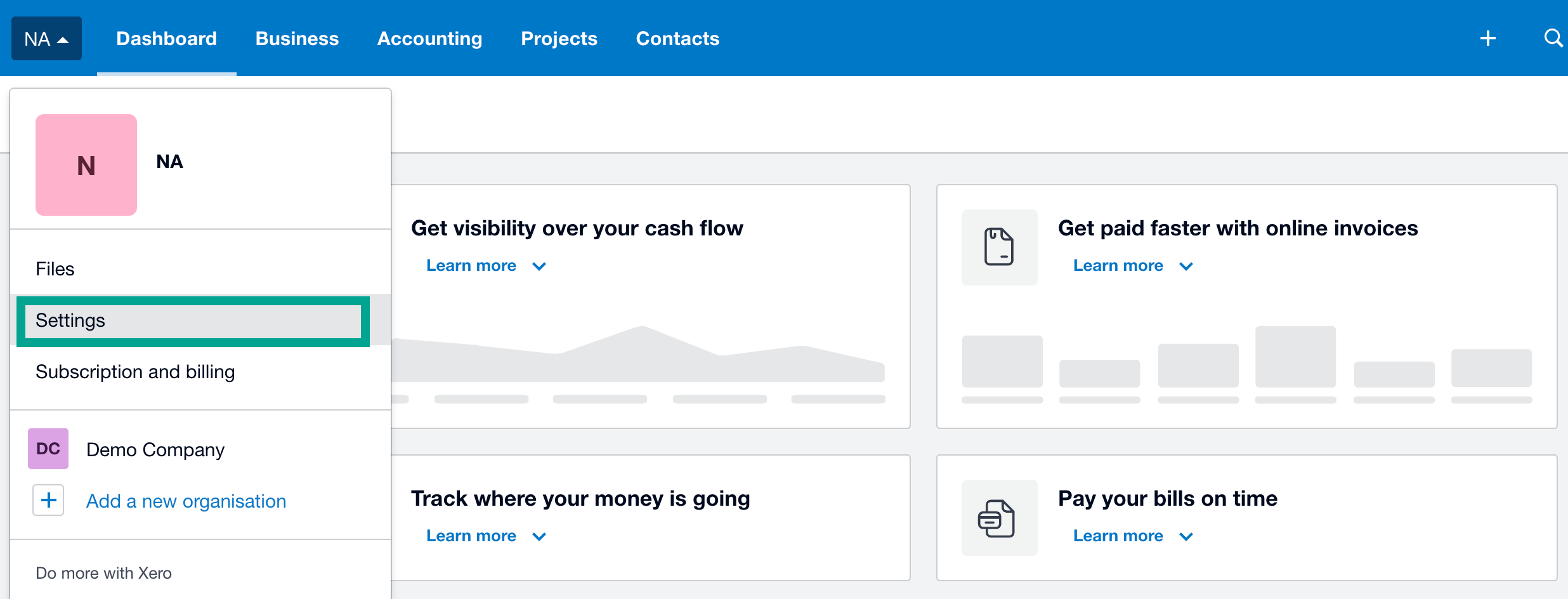

- Click the name of the vendor, then click, “Settings.”

- Go to “Invoice Settings.”

- Select “New Branding Theme.”

- Enter a label to reference this specific Xero invoice template in the future. Something like “Client XYZ Monthly Invoice Template” would work.

- Customize the invoice design and make any adjustments needed.

- Click “Save.”

- To look at saved invoice templates, find the name of the template you want to view or use and click “Preview.”

Xero Proforma Invoices

Most businesses send invoices after the goods or services are provided, but if your organization relies on proforma invoices that are used before your offerings are provided to end users, Xero hasn’t left you out. Xero proforma invoices are similar to the Xero invoice template, but they are structured slightly differently to fit your business needs.

Xero for Invoice Processing in Accounts Payable

On the other side of the invoicing process, the accounts payable team works tirelessly to process incoming invoices, verify that goods and services have been received in alignment with what’s on the invoice, navigate the payment approval process, and submit payments to awaiting vendors.

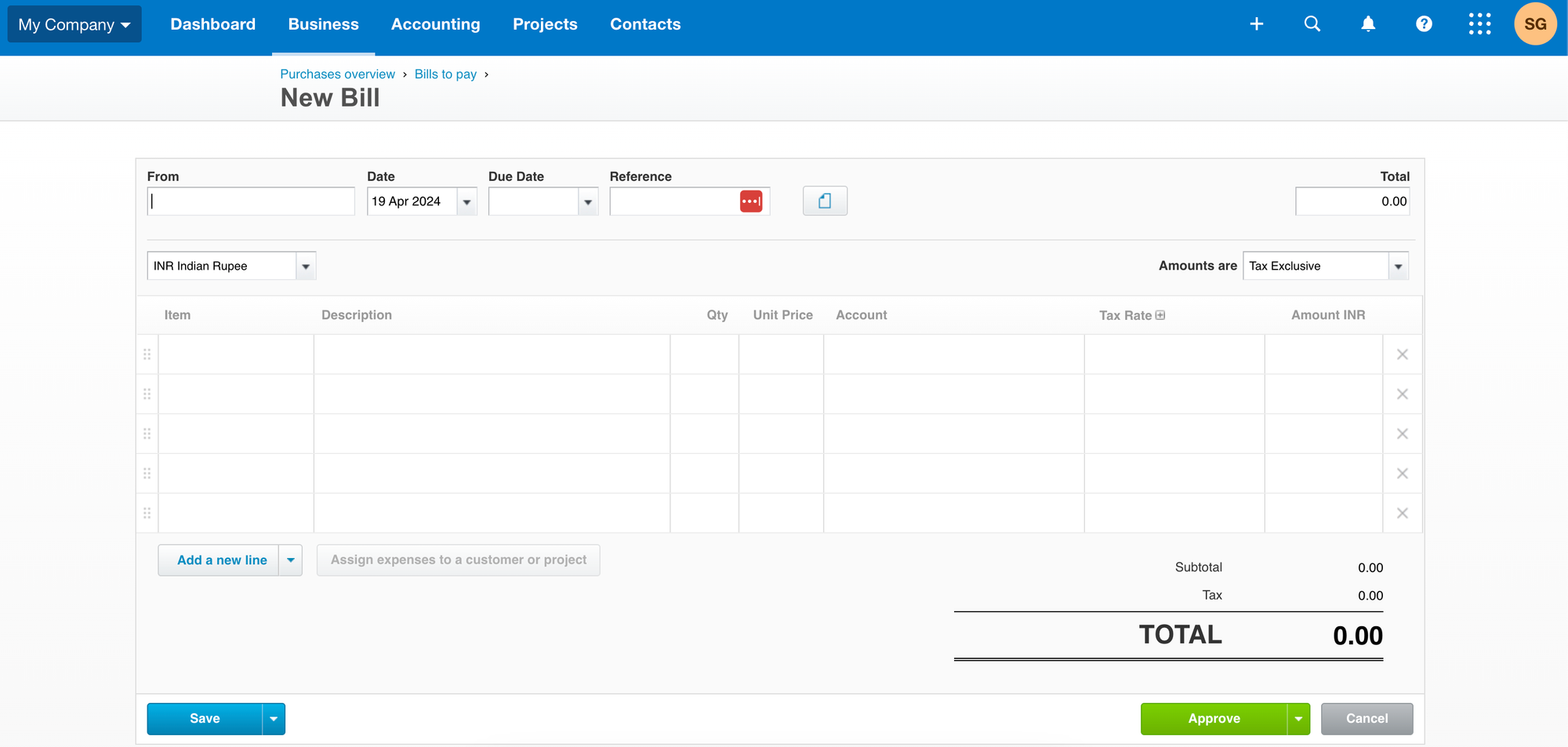

How to do AP in Xero

Just like their AR counterparts, the AP team members can lean on Xero invoice software to make their lives easier in a number of ways. Perhaps the most prominent function of Xero in the AP space is the import and processing of an invoice.

Step-by-step, here’s what that may look like:

- After an invoice is sent by a vendor, you can upload a PDF of the invoice into Xero.

- To verify invoices or initiate the approval process, go to the “Business” menu and select “Invoices.”

- Conduct manual invoice verification by comparing the item description, amount, and price with the goods or services received.

- Once it’s ready for approval, the approver can click “Approve and Email” to send the invoice to be paid.

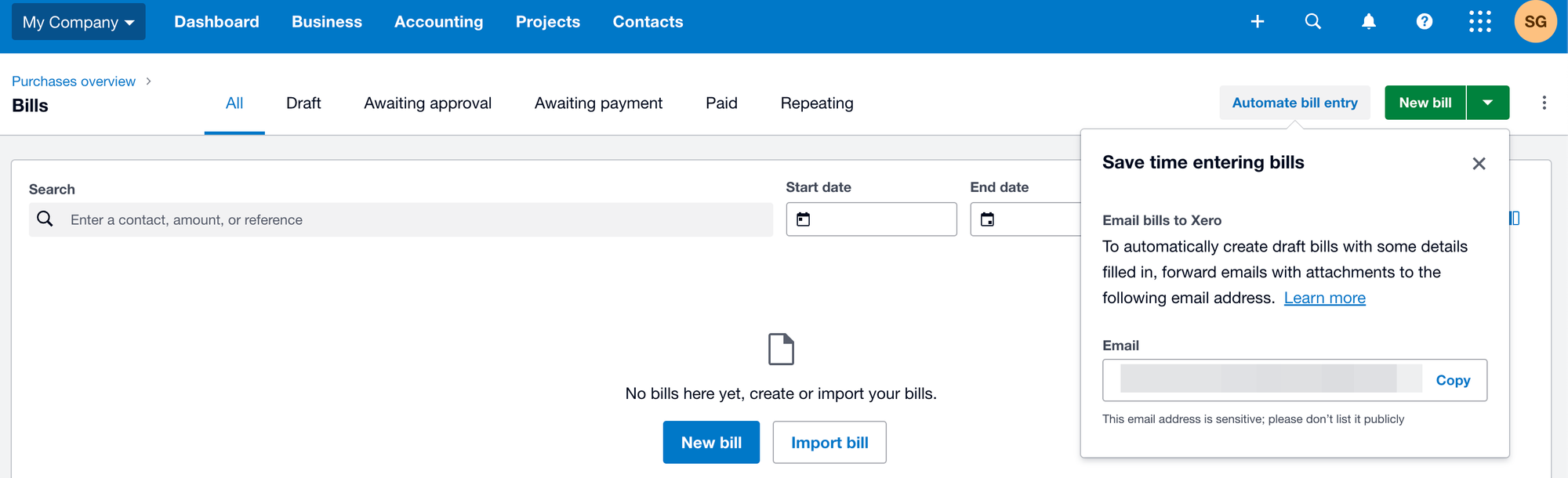

You can also forward bills to a specific email address to scan some details filled in

Other Xero features AP teams love are:

Simple Bill Management

Keeping track of outstanding short-term debts can be challenging; with a wide range of invoices due at different times throughout the months, AP teams have their administrative work cut out for them. With Xero invoice software, tracking upcoming due dates and outstanding bills becomes automatic.

Batch Payment Capabilities

By enabling batch payments within Xero invoice software, AP teams can enjoy much less manual data entry and reduced processing time when making payments.

Approval Workflow

With the customizable approval workflow capabilities within Xero, AP teams can send invoice payments through the proper approval channels all in the platform itself. No more long email chains and delayed payments due to inbox clutter.

Bank Reconciliation

Xero automates reconciling payments made to bills, simplifying the process of matching transactions with corresponding invoices. This feature ensures accurate financial records and reduces the risk of errors.

Notable Gaps in the Xero AP Process

It’s clear that Xero provides a major lift to accounting teams within growing businesses in a wide range of industries. The platform is reliable, well-tested, and ever-evolving, but there are so many other ways to enhance AP and AR processes with automation-centric tools. Simply put – there are a lot of things that Xero can’t do, too. Some of the biggest limitations for AP teams using Xero invoice software are:

Invoice Capture Limitations

Xero is great for scanning and storing business documents like invoices, but it’s very limited in extracting key data points from scanned images. This leaves AP teams stuck with manual data entry tasks every time a new invoice is received. Talk about a time suck!

Business Complexity Limitations

Xero invoice software doesn’t provide too many customizations for invoices and bills, making it hard to streamline AP processes.

Approval Workflow Limitations

If you’re looking for an ultra-complex workflow setup or an adaptive workflow depending on the invoice amount, you’ll need a supplemental automation tool to make that reality.

Reporting Limitations

In a time when business leaders expect real-time insights when making decisions, Xero won’t be able to provide the level of detail needed to make data-driven decisions you can trust.

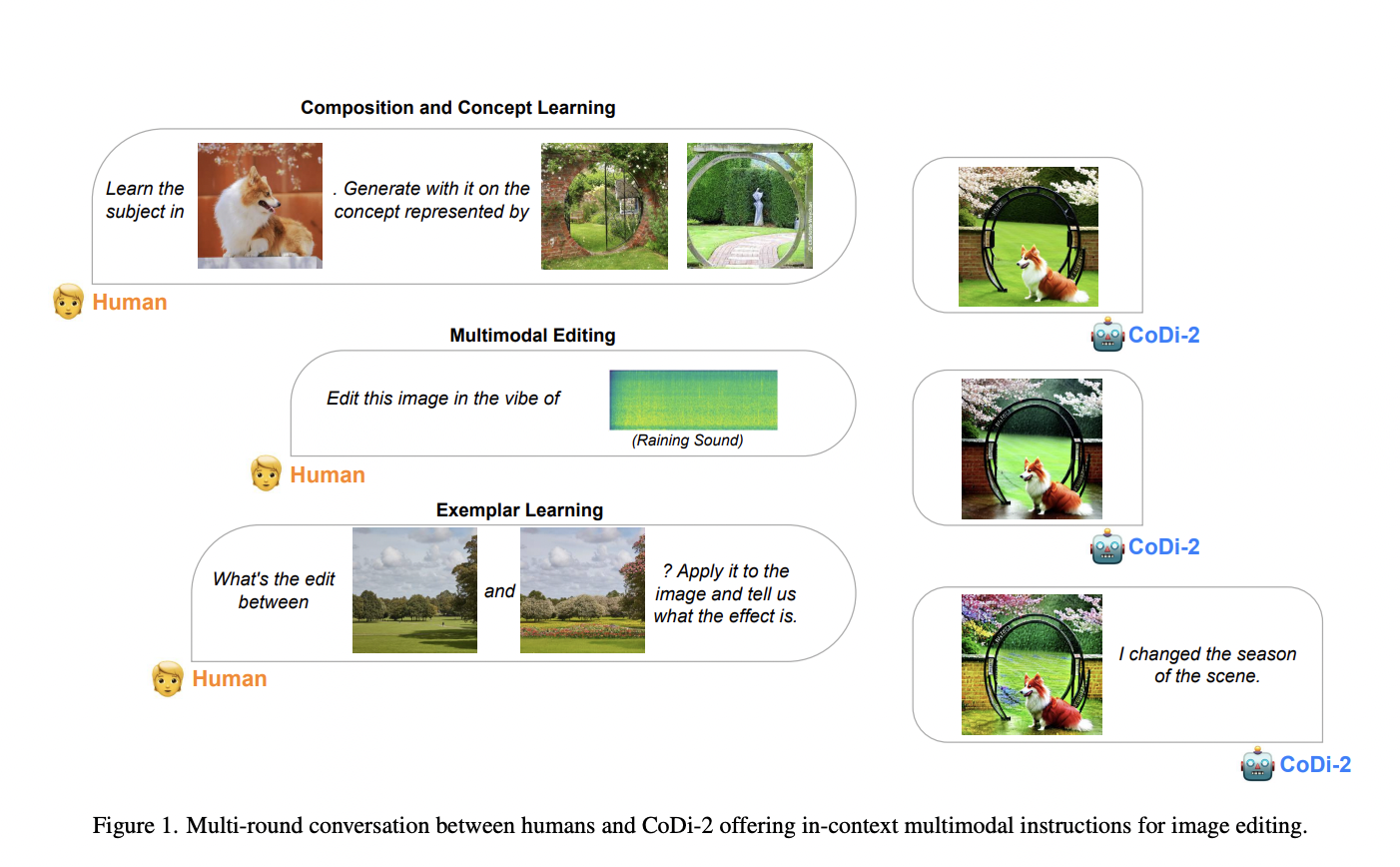

Nanonets for AP Automation

Let’s be clear: Xero adds immense value to the accounting cycle as a whole. The digital SaaS solution helps bring businesses into the digital age, but with the right integrations and supplemental tools, Xero can do so much more. With Nanonets, an AP automation SaaS offering, all of the AP gaps revealed above can be addressed quickly.

Using Nanonets to Automate AP in Xero

After integrating Nanonets with Xero invoice software, you’ll love the boost that AP automation gives to the function overall. For instance:

OCR Technology and Automated Invoice Processing

Using Optical Character Recognition (OCR), Nanonets can read and extract key data from incoming invoices and reduce manual data entry. Don’t worry; invoice records will be recorded in Xero, too, ensuring perfect data matching between the two platforms without any human intervention. Now, processing invoices – including two-way and three-way matching – can be done automatically.

Payment Automation

With Nanonets integrating Stripe, Wise, and ACH, payment automation isn’t just a dream; it’s a reality. AP teams can use the Nanonets and Xero integration to automate the payment process. Customized rules can be put in place throughout the process, too. Build a personalized approval workflow, set payment limits, and enhance security with other rules.

Vendor Management

Selecting vendors is hard enough; keeping all their information updated and correct in Xero can be a never-ending job. With Nanonets, vendor information can be automatically updated based on current invoice data, making vendor management as simple as possible.

Next-Gen Reporting

From the beginning, dashboards and automated reporting features have been part of Nanonets’ offerings. With just a few click-and-drop exercises, your AP team – and other accounting teams – can have reports that cover all the bases.

How Nanonets and Xero Work Together

Setting up the integration between Nanonets and Xero usually only takes a few minutes. Below is an illustration of Nanonets taking in invoices from multiple sources like DropBox and GMail and processing them.

This isn’t restricted to only invoices but also PO and other documents. After approval in a workflow which you can setup, the data is ready for a sync in Xero.

Nanonets can process invoices, extract key information, deliver that information to Xero, and automate processes. This integration has been available for years, making it something that you and your organization can start to benefit from NOW. Don’t wait to experience the benefits of Nanonets and Xero; get started now.

Benefits of Pairing Nanonets with Xero

Powerful apart and unstoppable together, Nanonets and Xero are ready to change how accounting professionals work. It’s no longer enough to have a strong ERP or easy-to-use accounting solution; automation is a must for all businesses, and with Nanonets, the automation journey becomes much more manageable.

By investing the time and resources into setting up these tools, you’ll see a return on investment materialize in many different ways.

- Productivity – Firstly, productivity will skyrocket. Automation does more than make tasks more efficient, it also enables your AP and AR teams to focus their efforts on more value-add aspects of the business.

- Financial Gain – Enhanced productivity leads to improved financial results for businesses.

- Team Satisfaction – Nanonets and Xero make the people doing the work less stressed and happier in their jobs overall. When you have a happy staff, the whole world opens up.

When used together, you can enjoy all of the accounting prowess of Xero with the automation power of Nanonets. As productivity starts to rise, manual errors start to fall, and your customers and employees get happier and happier, you’ll be so glad you did.

Business leaders who are really looking to shake things up should look no further; these tools will change the way your business runs from start to finish. To get started today, link Nanonets with Xero and get to work!