Intercompany reconciliation is specific to companies with multiple subsidiaries under the same parent group. It’s a crucial step in the intercompany accounting process and for preparing a consolidated statement for financial reporting.

Intercompany accounting is significantly more complicated than standard accounting since it requires balancing multiple ledgers, tracking internal/external transactions, forex conversion, performing intercompany eliminations and settlements, and preparing a consolidated financial statement. For enterprises, the traditional accounting process can cost millions of dollars and take 2-4 weeks to finalize!

This article provides the most comprehensive guide to intercompany reconciliation and how automation can help you save time & cost!

Key Takeaways:

- Intercompany reconciliation is done between companies with the same parent entity.

- Reconciliation helps remove duplicate entries and rectify errors. This is essential for financial reporting and tax compliance.

- Determine the scope of your work and gather documents like general ledger/invoice/bank statements, etc.

- Match the documents using document ID or amount/date combo. Continue this process till all transactions are matched.

- Resolve discrepancies by verifying the details using supporting documents in coordination with affected business units.

- Streamline your intercompany reconciliation by standardizing tools, rules & processes. Automate reconciliation to improve accuracy and save time & cost.

Let’s first understand intercompany accounting and how intercompany reconciliation is essential in the process.

What is Intercompany accounting?

Intercompany accounting is based on the simple concept that transactions between group companies are irrelevant to the financial health of the consolidated entity. A company can’t profit or lose by doing business with itself, and thus, ‘intercompany transactions’ are canceled out from consolidated financial statements.

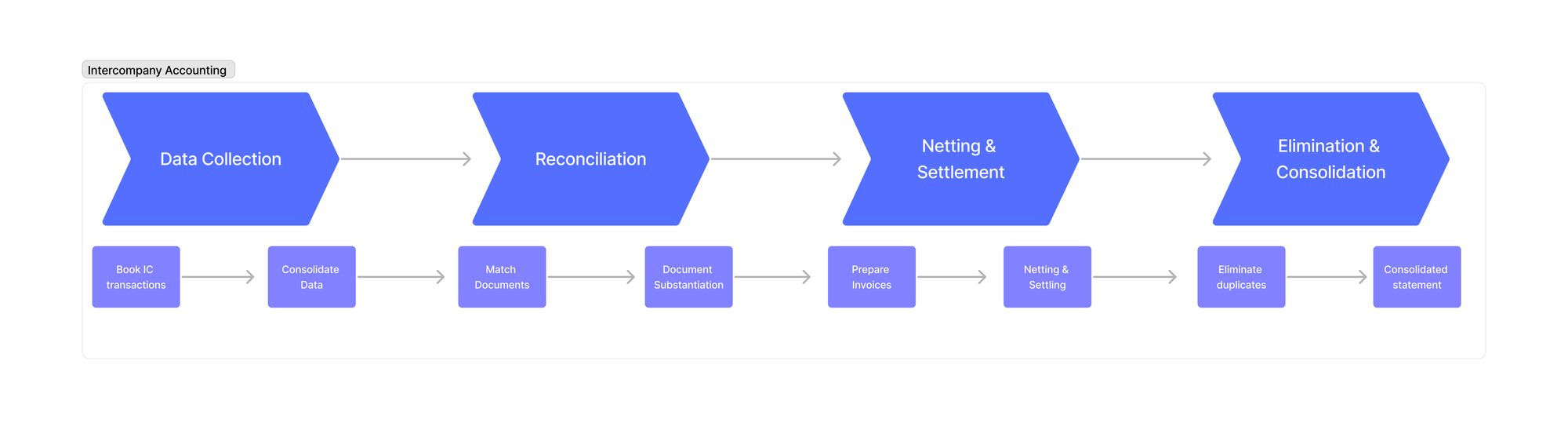

We can divide the accounting process into 4 steps:

- Data Collection: Each subsidiary company maintains its sub-ledger. This has to be finalized and shared with the parent company. Along with this, supporting documents like invoices & receipts are attached for verification.

- Reconciliation: Intercompany transactions are matched, verified, and documented with supporting documents. An account is considered reconciled when all the internal transactions can cancel out each other.

This article will focus on the first two steps – Data Collection & Reconciliation.

- Netting & settlement: This involves the actual cash transfers based on intercompany accounts receivables & payables. The outstanding balances are cleared out, and the companies can reflect this in their sub-ledgers.

- Eliminate & Consolidate – Intercompany transactions like purchasing goods from Sub-A by Sub-B can be eliminated and removed from the statement. However, intercompany transactions that affect the consolidated financials are not eliminated. This can be investments or transactions with partially owned subsidiaries. After reconciliation and elimination, the finalized consolidated statement is prepared.

Now, let’s move to reconciliation:

What is Intercompany Reconciliation?

Intercompany reconciliation is the process of matching and verifying transactions between companies of the same parent group.

What are intercompany transactions? They are transactions between group companies like parent <> subsidiary or subsidiary <> subsidiary. These transactions include purchasing goods and services, transfers of human resources, loans, joint costs, ownership changes, dividends, and royalties.

A company’s transactions are first segregated into intercompany and external transactions. The external transactions go through the routine account reconciliation procedure, where the general ledger is matched with documents like bank statements. Meanwhile, the intercompany transactions are matched with the general ledger of the respective companies.

Here are a few examples of intercompany transactions:

Meta is the parent company for entities like Facebook, Whatsapp, Instagram, and Quest. These companies can interact with each other for various purposes:

Loan: Facebook loans Instagram the capital to scale its user base. This creates a liability on Instagram’s sub-ledger but an asset on the Facebook sub-ledger. For Meta consolidated, no liabilities or assets are being created.

Purchase/Sale: Quest is buying Instagram ad space to boost its revenues. This is recorded as an expense in the Quest sub-ledger and revenue in the Instagram sub-ledger. Meta’s consolidated financial statement cancels the two and isn’t reported as revenue or expense.

Why is intercompany Reconciliation important?

Intercompany reconciliation is an essential step for companies with subsidiaries. Its primary aim is to accurately account for all transactions and adjust accounts according to intercompany accounting rules.

This process is critical for audit, taxation, and legal compliance. However, it is prone to errors due to its complexity. According to a Dimensional Research survey, 43% of intercompany professionals felt their books were at risk of an SEC investigation, and 38% responded that they could potentially incur tax penalties. Here is why you need to do intercompany reconciliation:

- Identify Accounting Errors: Transactions can be incorrectly reported in one or both of the ledgers due to errors. Reconciliation will help align the two sub-ledgers.

- Tax Compliance: Group companies must prepare a consolidated financial statement adjusted by Generally Accepted Accounting Principles (GAAP) or another accounting standard. The internal transactions are subject to different tax rules, making it essential to report them correctly.

- Investor relations: Public companies are obligated to present a consolidated financial statement to their investors. Misrepresenting financials can lead to scrutiny from the SEC.

- Financial Planning: Get an overall understanding of the business with a consolidated statement. This can help you better understand the expenses & income of each company.

Intercompany reconciliation is an important and necessary accounting step for enterprises or even small businesses with different entities. Here’s a guide on how you can do intercompany reconciliation.

<CTA>

How to do intercompany reconciliation?

Nearly 85% of accountants agree that intercompany reconciliation is complex and messy. It has to be structured into groups to reduce the complexity, and the process has to be automated to save you time.

The complexity stems from the fact that there are many types of transactions – debt, equity, human resources, products, or services. This is split between several companies with transactions in different currencies.

The following steps will help you get started with intercompany recon:

Step 1: Determine Scope

You must begin by defining the accounts you intend to reconcile and specifying the period for reconciliation. In enterprises, multiple accountants work on this, and the company has to define the scope and split the work.

The scope can be determined in various ways:Geography: Group companies located in close geographical proximity often share similar accounting and tax regulations. Additionally, utilizing the native currency simplifies the reconciliation process, as there is no need to account for currency conversion and associated margin of error. This makes it the most popular way to define the scope. For example, Accountant A handles all EU accounts, while Acc B handles all American accounts.

Business Groups: Group companies doing related work are expected to have frequent intercompany transactions. For example, Amazon can group its cloud service-related businesses together, while e-commerce can be a different group. You can also segregate based on the equity ownership structure of internal companies.

Transaction Type: Segmenting the reconciliation process by transaction types, such as sales, loans, or equity-related transactions, can simplify the task by allowing you to focus on one transaction type. However, it may lead to redundant work due to ownership considerations, local laws, and forex adjustments.The scope provides you with the accounts that you need to reconcile. You will also have to define the period of reconciliation. Once all groups are reconciled, a group accountant can check the reconciliation, perform eliminations, and consolidate the statement.

Step 2: Select a Reconciliation Tool

The extensive manual processes involved in intercompany reconciliation often consume a significant portion of your finance teams’ time, resulting in a prolonged account closure period of 3-4 weeks.

However, by implementing automation, you can streamline these processes, significantly reducing the burden on your team and improving turnaround times. The time saved can be better utilized to delve deeper into financial analysis and to enhance strategic financial planning initiatives.

Here are the key things to keep in mind while choosing a reconciliation tool:

• Integration with Tools: Your companies might not have standardized processes & tools, which can result in working with various ERPs and accounting software. A workflow automation tool like Nanonets can seamlessly integrate with your ERPs and allow you to consolidate all your documents in one place.

• Automate Matching: Most transactions can be matched automatically based on reference ID or transaction details. The important aspect here is having customizable matching conditions – exact match, partial match, match with tolerance, and more. SAP s/4 HANA offers several pre-set matching options, while Nanonets allows you to set any matching method using generative AI.

• Robust & Flexible: You would need a flexible system to help set up different rules to manage operations and compliance across jurisdictions.

• Collaboration: The tool has to offer functionality to let your team work together on the overall task. The features you should look for are admin controls, notes, user action history, and approval routing.

• Reporting and Analytics: The software should provide insights into the data; this can be used to identify errors through reconciliation or to make quick financial analyses.• Security & Compliance: Companies can be legally constrained not to share any form of confidential statements with third parties. The software must be GDPR & SOC-compliant and should have an on-premise deployment option.

<CTA>

Step 3: Collect Data

Documents Required

First and foremost, you need the general ledger of each company, containing comprehensive journal entries for all intercompany transactions. Furthermore, you must add supporting documents to solve the discrepancy for verifications and unmatched transactions.

To understand what supporting documents you need, let’s go by transaction type:

- Intercompany Sales and Purchase: Intercompany sales and purchases are among the most common transactions between group companies.

In the general ledger, the buyer records purchases as expenses and Accounts Payable if payment isn’t made immediately. In contrast, the seller records it as revenue and Accounts Receivable if payment isn’t made immediately.

The supporting documents are purchase orders or payment receipts from the buyer and invoices from the seller.

- Intercompany Loans & Leases: These types of transactions occur when one entity within the group lends money or infrastructure to another group entity.

In the general ledger, the lender records the loan as an asset in the balance sheet under “notes receivable,” while the borrower records it as a liability under “notes payable.”

The supporting document would be the loan agreement or the loan disbursement payment records.

- Equity Transactions: Group companies are likely to share ownership in related companies. Equity transactions like the purchase of shares or dividends fall under this bucket.

The sale/purchase of equity is recorded in the ‘statement of change in equity’ and can be verified through the ‘Ownership Agreement.’ The dividends can be verified through a ‘dividend declaration form’ or payment records.

This should cover the transactions that you see frequently. To recap, these are the documents that you require:

- General Ledger

- POs/Receipts/Invoices

- Bank statements or payment records

- Loan agreements

- Ownership agreements

Data Collection

You must collect the above documents and store them in a centralized document management system. This process is quite straightforward if your group companies store documents in the same tool.

However, if your data isn’t organized, you will be required to collate the data from three primary sources – ERPs, emails, and banks. For manual reconciliation, you must extract the data from each source in CSV and store it in a common format.

This process is complicated to do manually as you are required to pull data from multiple sources and work with different ERPs & tools. Automation tools like Nanonets can integrate with your ERPs, email, or bank to extract relevant information using OCR and present it in the required format.

Step 4: Match Transactions

The matching process is done at a transaction level, where transactions are matched until the reconciliation difference equals 0.

In this process, we must first adjust transactions to the base currency, establish rules for matching the transactions, and include a reason code.

Forex Adjustment: Set a currency adjustment rate and convert all transactions into one currency.

Matching Method: Define the fields that you require to match – this could be amount, date, transaction ID, etc. Then, set a matching method to define the rules of matching. You can select – exact match, match within the tolerance limit, group matching, etc.

For example, let’s say you match the transaction between an EU & US business unit. The EU unit buys an item for $1000 or €925 and clears the payment 7 days later.

As currency rates fluctuate, the €925 was worth $998 at the time of payment. You can match the transaction while ignoring the difference. You can set up ‘matching with tolerance’ to do this automatically.

Matching transactions manually is one of the most time-consuming parts of the reconciliation process. This can be easily automated by defining the matching logic and even through generative AI-suggested matches.

Reason Code: Along with the matching method, you must assign reason codes that help explain why a particular transaction was matched. This is helpful when troubleshooting and for others to understand your work.

Step 5: Resolving discrepancies

We could have a case where one of the units may have missed a transaction or recorded it incorrectly. In such cases, check out supporting documents like invoices and work with the respective business unit to record the entry accurately.

At times, discrepancies may not get resolved promptly. In these situations, we can conduct a materiality assessment. We may overlook transactions if they don’t have a notable impact on our financial statements.

For transactions with substantial value, we can create an adjustment entry of the disputed amount. This adjustment should be allocated to an “unresolved discrepancy” account. While this doesn’t entirely solve the issue, it helps us reconcile the statement for now.

Don’t forget to document this discrepancy, get management approval, and reference it through the statement.

Step 6: Netting and Settlement

Netting is the process of aggregating financial transactions into a single amount.

Let’s say A owes $1000 to B, and B owes $900 to A. Netting would simplify this, and A only needs to pay B $100 ($1000-$900).

Settling is clearing outstanding dues in the accounts receivables/payables and making the cash.

Step 7: Elimination and Consolidation

The reconciliation process finishes once you have matched all transactions and the difference hits 0. You can now add documents for substantiation and get them approved by management.

After this, you can perform intercompany eliminations and remove the duplications. This is finally used in the consolidated financial statements.

Best Practices in Intercompany Reconciliation

1. Standardize tools & processes.

You must set a standard that all the subsidiary accounts can follow. The things you need to standardize –

• Document storage – Create a list of documents required, set a standardized data format, and store it in an easily retrievable tool.

• Accounting rules & practices: Group companies might differ in expense categories, accounting codes, depreciation methods, pricing methodologies, and other financial reporting practices. You would need to ensure consistency to simplify the reconciliation process.

• Timelines: A difference in billing cycles can lead to discrepancies that must be adjusted on a case-by-case basis. This makes it harder to automate the process. Furthermore, intercompany reconciliation requires each company to present an accurate financial record, and the timelines for this have to be communicated.

• Tools: Utilizing the same software across the group makes tracking transactions, matching transactions, and reconciling balances easier.

2. Frequent Reconciliation

Performing regular reconciliations enables you to identify any discrepancies promptly. Waiting until the end of the quarter can confine you to a tight timeframe, while differences may take longer to resolve. This is why companies are increasingly adopting automation, allowing them to conduct weekly or even daily reconciliations.

3. Automate Reconciliation Software

Manual reconciliation has two main disadvantages – time and accuracy. Automation software can simplify your life by:

Unified interface: Automatically sync data from your existing applications like QuickBooks, Xero, Gmail, or your bank website. This will enable consolidating all your financial statements and processes under one roof. Resulting in increased transparency for you and your team.

Improve Accuracy: Manual reconciliation can result in errors, necessitating multiple rounds of reworking the process. Most companies don’t have a robust process, which results in errors in their intercompany accounting process. According to a Deloitte poll, merely 9.2% of companies express confidence in their intercompany accounting process.

A single mistake can add hours to your workload. Not only does automation software reduce the number of errors, but it also frees up time, allowing you to allocate that time to verify the process.

Save Time: With Nanonets, reconciliation can be done weekly, daily, or even instantly. This helps save your team time from the manual work and allows your finance team to produce better reporting and insights.

Save Cost: Match your transactions through Gen-AI and implement your business logic using no-code workflows to flag any irregularities. This will help quickly detect errors/frauds and help safeguard your company.

Simplify Compliance: Teams can often face a challenge in preparing GAAP-adjusted financials in time for reporting. You can set up rules to make the adjustments in-app through workflow blocks.`

If you want to automate your month-end reconciliation process, set up a demo call with our experts to automate your workflows using Nanonets.

<CTA>

Conclusion

Intercompany reconciliation is a part of intercompany accounting. The process involves matching and verifying transactions to ensure accuracy in financial records. This process is generally done monthly or quarterly and can take up to 2+ weeks to finalize.

The steps to intercompany reconciliation involve determining scope, selecting a tool, collecting data, matching, and reconciling. Automation software can save you time on each and every step of this process.