Xero is cloud-based, SaaS accounting software for small business customers located in many countries. The Xero company, founded in 2006, is New Zealand-based. Xero’s software handles accounts payable as a traditional system requiring manual data entry. For Xero accounts payable automation, Xero customers integrate third-party AP automation software.

How to manage AP on Xero

Manage accounts payable (AP) on Xero by performing these necessary processes:

- Receive a vendor invoice or another bill by email to the Xero accounting system or by scanning

- Approve the invoice

- Schedule payment

- Xero adds invoice/bill to accounts payable

- Payment made

- Invoice/bill marked as paid

But notice that these steps performable within Xero don’t cover a lot of manual tasks. For example, accounts payable department employees need to visually determine that invoices are correct through manual verification processes and obtain approvals.

These accuracy verification processes include 3-way matching (or 2-way matching) of the invoice with the purchase order (PO) and a receiving report, if applicable, for the receipt of goods.

AP staff needs to determine which designated budgetary manager(s) needs to approve the invoice, in accordance with company expense policy. Then accounts payable routes the matched (often paper-based) documents to the right approver and follows up with approvers when their approval isn’t timely.

Accounts payable pays the invoices in a batch. Perhaps accounts payable still uses old-school paper checks. When using paper checks, these manual steps are required:

- Having the CFO or Controller approve the check run

- Getting authorized check signatures

- Printing checks on paper

- Separating and filing a check copy with the matched invoice document copies

- Stuffing and mailing envelopes with the checks and attached remittance advices

- Responding to incoming supplier calls or emails requesting current payment status

Xero accounts payable workflows

The following descriptions relate to Xero accounts payable workflows for performing accounts payable processes in the Xero core accounts payable software.

Capture and enter supplier bills/invoices

Users of Xero’s Business edition plans, which include Early, Growing, and Established SaaS pricing plans, receive the built-in Hubdoc feature that captures bills and receipts in Xero. Hubdoc is a Xero partner for OCR data capture that extracts data from documents and creates transactions in Xero. The Xero bills email address shows on any status tab in the Purchases overview page.

To capture supplier bills and invoices in Xero using the Hubdoc feature, the bill must be an email attachment rather than embedded in the email itself. For this email capture process, you will forward bills received from any supplier to your Xero bills email address.

Most document and image formats work when e-mailing bills to your Xero organization’s unique email address to create a draft bill with an attached emailed bill. You can email up to 10 bills in a single email which will create separate bills in Xero. The maximum email size is 25MB.

The emailed bill will be in your company’s base currency rather than a foreign currency. Only with a subscription that includes multicurrency, you can manually change the currency on the draft bill or invoice to the foreign currency in Xero.

Only if Xero can read the emailed bill successfully, some fields, including these, will auto-populate and be designated in Xero by a lightning bolt icon:

- Contact

- Date

- Total

- Due Date

- Reference

Notice that this invoice capture process may not be complete or accurate and still requires performing manual steps (listed in the Xero link for e-mailing bills) in the Business/Bills to Pay menu and for required currency conversion.

If you don’t use Xero’s Hubdoc feature for emailed bill data capture, you need to perform manual data entry to add invoices and bills into the Xero accounting software system. In the Business/Bills to Pay menu, select New Bill and enter details for the fields. Save the bill and send it for approval before paying the bill.

You will manually code these accounts payable bills to the correct expense or asset account, such as inventory.

Pay bills and record payments

To pay bills, schedule bills in the system (by batch) by entering the payment date and applying a checkmark to invoices being paid. When the bill is paid, Xero records the transaction as a reduction in accounts payable as a debit and a balancing double-entry bookkeeping credit to cash (and any early payment discount taken).

Adding new suppliers

In Xero accounting software, Xero sets up new suppliers as Contacts and determines how you use these Contacts—either as Suppliers or Customers, or both. If you load a bill, the Contact is used as a supplier. Therefore, you don’t need to move Contacts to Suppliers. When you use Hubdoc in Xero, Hubdoc will automatically set up the supplier in the Xero accounting software system for you when the invoice is received. Otherwise, manual data entry is required to set up suppliers in Xero.

Manage expenses and reimbursements

With Xero, you can see and manage invoices, expenses, and reimbursements from the cloud-based online software or with a mobile device that uses the Xero app. Your visibility into spend management will not be as comprehensive as it would be with AP automation software integration.

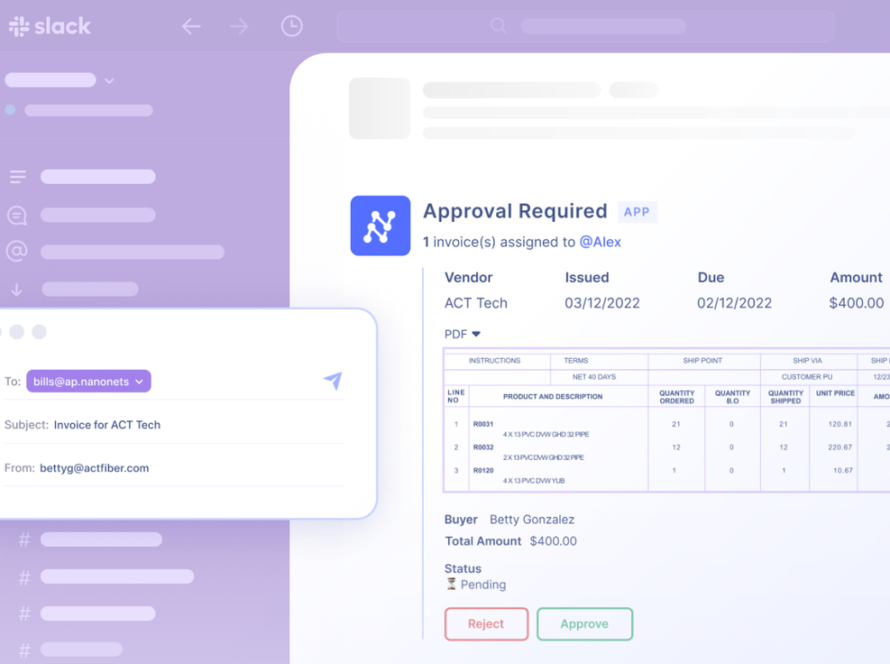

Automating Xero AP workflow with Nanonets

You can fully automate all Xero AP workflow for invoice receipt and invoice processing, including payments, with Nanonets Flow, its AP automation and invoice processing software for accounts payable. Nanonets uses accounts payable best practices in its AP automation software.

Nanonets helps you achieve vendor onboarding easily and have excellent document management related to accounts payable. Suppliers choose a payment method.

Nanonets Flow AP automation software lets you forward emails or scan invoices into Nanonets with AI/ML-enhanced intelligent OCR (optical character recognition) to capture invoice data electronically by line item with headers. But Nanonets is an OCR expert and has a much higher accuracy rate of capturing invoice data than Xero with HubDocs can reliably provide for every invoice. Nanonets AI-data entry is the key to unlocking accuracy and efficiency.

Nanonets gives your business timely, touchless invoice processing, without human intervention or manual processes that’s powered by artificial intelligence (AI) and its subset, machine learning (ML). Automated software Invoice processing includes steps for verifying invoices, invoice matching, approving invoices for payment, and paying approved bills and invoices in batches.

You’ll be able to claim vendor’s early payment discounts when you pay within the short number of days indicated on your invoice payment terms, like paying within 10 days for 2/10, net 30 to receive a 10% discount from the invoice balance due instead of paying the full invoice amount in 30 days. When you take early payment discounts on trade payables for inventory items, the cost savings are impressive.

With Nanonets, after you capture the invoice data, Nanonets verifies the invoices and account coding and syncs that data with your accounting system. Nanonets matches invoices with supporting documents, including purchase orders (POs) and goods receipts when applicable.

Your business can set up invoice approvers and spend limits compliant with your company policy or let AI handle invoice approval workflows automatically for you within Nanonets if you prefer. Approvers have the choice to Reject or Approve invoices for payment.

Schedule and make global electronic payments in a choice of currencies using efficient, large batches with Nanonets. Then Nanonets will reconcile and match internal records or transactions or payments with bank accounts, credit card statements, or other sources for account reconciliation.

Nanonets gives your business team intelligent views with visibility into business spend, giving you more control to manage business costs.

Conclusion

The Xero accounts payable workflows are very time-consuming. When your business begins streamlining workflows with Xero + AP Automation, the accounts payable staff will not need to perform these repetitive manual data entry steps for every supplier, invoice, or employee expense report requiring reimbursement.

Find out how Flow by Nanonets can supercharge Xero accounts payable automation workflows and provide more accuracy and financial controls.